ASX investors have enjoyed a pretty decent start to the new year. In fact, the S&P/ASX 200 Index (ASX: XJO) capped off the first month of 2024 with a record high.

And with the December-quarter inflation figures coming in cooler than expected, market chatter abounds on whether interest rate cuts might be on the horizon sooner rather than later.

This means that right now could be the ideal time for ASX shareholders to top up their portfolios and for beginner investors to take the leap and buy their first stocks.

To that end, we asked our Foolish writers which top ASX shares they reckon should be on your buy list this month. Here is what the team came up with:

7 best ASX shares for February 2024 (smallest to largest)

- Accent Group Ltd (ASX: AX1), $1.14 billion

- Elders Ltd (ASX: ELD), $1.41 billion

- L1 Long Short Fund Ltd (ASX: LSF), $1.81 billion

- Vanguard Australian Property Securities Index ETF (ASX: VAP), $2.73 billion

- Neuren Pharmaceuticals Ltd (ASX: NEU), $3.01 billion

- Domino's Pizza Enterprises Ltd (ASX: DMP), $3.56 billion

- Netwealth Group Ltd (ASX: NWL), $4.11 billion

(Market capitalisations as of market close 31 January 2024).

Why our Foolish writers love these ASX stocks

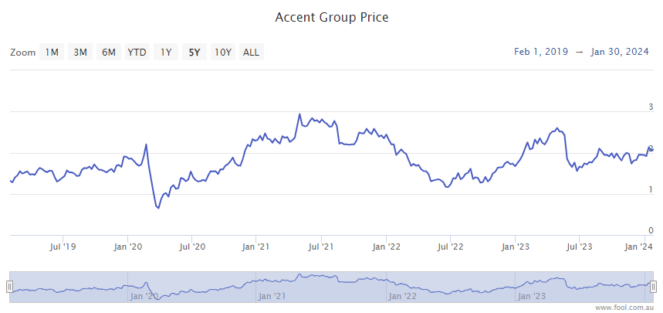

Accent Group Ltd

What it does: Accent distributes and sells shoe brands in Australia, such as CAT, Dr Martens, Henleys, Hoka, Kappa, Merrell, Skechers, Ugg and Vans. It also operates its own businesses, including The Athlete's Foot, Trybe, Stylerunner, Nudy Lucy, and Glue Store.

By Tristan Harrison: Accent has done a good job of growing into the retail business it is today, with major global shoe brands electing to partner with it.

The Accent share price is still down around 20% from April 2023, giving investors an opportunity to invest in the company at a much lower valuation. Sales and profit may be challenged in 2024, but I think the long term looks promising, particularly if/when households start spending normally.

Accent is continually growing its store network and, interestingly, generates around a fifth of total sales from digital retail. I'm confident the company can keep adding brands to its portfolio and further grow its own businesses.

According to Commsec, the Accent share price is valued at less than 13x FY26's estimated earnings with a possible grossed-up dividend yield of 10%.

Motley Fool contributor Tristan Harrison owns shares of Accent Group Ltd.

Elders Ltd

What it does: Formed 185 years ago, Elders has endured through a tumultuous slice of history. Today, the agribusiness has a hand in a wide array of segments, including agency services, real estate, agricultural chemicals, and animal health.

By Mitchell Lawler: The Elders' share price deteriorated as much as 45% last year, at its low, as livestock prices normalised.

The steep upswing in cattle and sheep prices incentivised a rapid increase in supply. As usual, these reactions often overshoot, creating an oversupply – an issue exacerbated by demand pressure wielded by the cost of living. This manifested as a weak set of numbers from Elders in its FY2023 results.

However, wet weather has supported improving livestock prices despite the El Niño declaration. Given the confluence of stabilising prices and wetter conditions, there's a reasonable chance – in my opinion – that Elders could return to growth this year.

Motley Fool contributor Mitchell Lawler owns shares of Elders Ltd.

L1 Long Short Fund Ltd

What it does: The L1 Long Short Fund is a listed investment company (LIC) that manages a portfolio of ASX and international shares on behalf of its investors. As the name suggests, its management can use both 'long' investing and short selling to generate returns.

By Sebastian Bowen: This LIC is on my radar this February.

I'm always on the lookout for managed funds and LICs that can demonstrate a history of being able to beat the market over long periods of time. Long Short Fund falls into this category, and as such, it has piqued my interest. How could it not, with a five-year average return of 20% per annum (as of 31 December)?

With an established track record of performance, this LIC is at the top of my watchlist this month.

Long Short Fund has proven to have had an uncanny knack for picking winners. Some of its most successful investments in recent times have been the likes of Mineral Resources Limited (ASX: MIN) and BlueScope Steel Ltd (ASX: BSL).

This fund has the ability to short-sell shares as well, which could give investors some protection in the event of a downturn.

Motley Fool contributor Sebastian Bowen does not own shares of the L1 Long Short Fund Ltd.

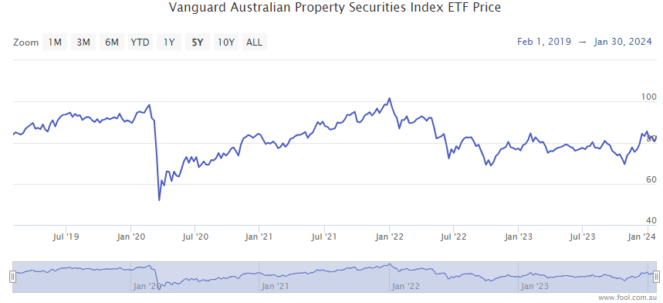

Vanguard Australian Property Securities Index ETF

What it does: This exchange-traded fund (ETF) aims to track the S&P/ASX 300 A-REIT Index, which consists of real estate investment trusts (REITs) that sit among the largest 300 companies on the ASX.

By Tony Yoo: Steep interest rate rises have been rough on the real estate sector over the past couple of years. That's reflected in the Vanguard Australian Property Securities Index ETF share price, which is now down about 17% from the start of 2022.

However, with interest rates now reaching or nearing their peak, the property sector could be in for a revival. If the Reserve Bank of Australia actually cuts mortgage repayments, the party will be in full swing.

February could provide an excellent low entry point for long-term investment in Australian real estate through this ETF.

Motley Fool contributor Tony Yoo owns shares of the Vanguard Australian Property Securities Index ETF.

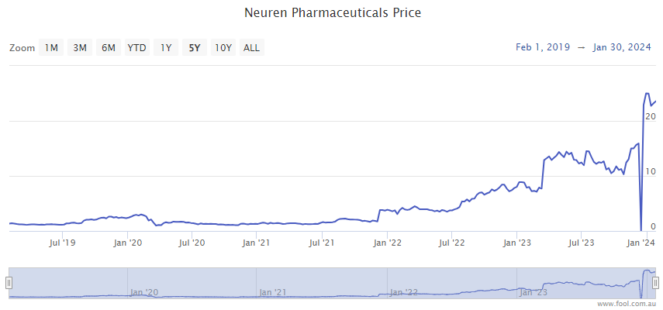

Neuren Pharmaceuticals Ltd

What it does: Neuren Pharmaceuticals is a biopharmaceutical developer specialising in drugs to treat neurodevelopmental disorders that emerge in childhood. In 2023, its first drug, Daybue, received FDA approval and went to market in the United States. It's the world's first treatment for Rett syndrome.

By Bronwyn Allen: The Neuren Pharmaceuticals share price recorded the highest growth of all ASX 200 stocks in 2023 at 214%.

After such a strong performance, it's interesting to note how many analysts are rating Neuren Pharmaceuticals shares a buy.

Clearly, they are unperturbed by the transformative change in the company's market cap last year and see more share price growth ahead.

Of the five analysts covering Neuren shares on CommSec, four rate the stock a strong buy and one a moderate buy.

Could Neuren Pharmaceuticals stock be a winner yet again this year?

Motley Fool contributor Bronwyn Allen does not own shares of Neuren Pharmaceuticals Ltd.

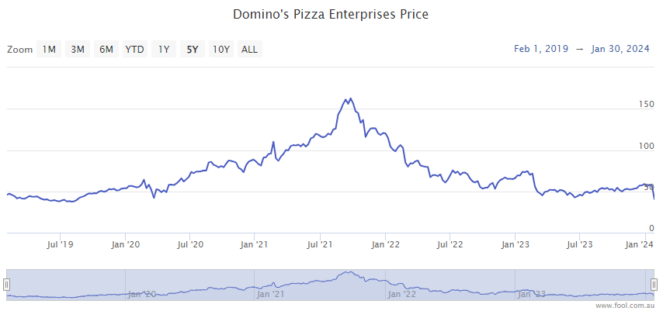

Domino's Pizza Enterprises Ltd

What it does: Domino's Pizza Enterprises is the exclusive master franchisor for the Domino's brand network in countries including Australia, New Zealand, Belgium, France, The Netherlands, and Japan.

By James Mickleboro: I think it is fair to say that the last 12 months have been a complete disaster for Domino's.

Management's pricing missteps in response to inflationary pressures, and a poor performance from most of its operations during the first half, meant its shares lost almost half their value since this time last year.

While this is disappointing, I believe it has created a compelling buying opportunity for patient investors with a very favourable risk/reward.

Citi appears to believe this is the case. Its analysts currently have a buy rating and a $61.10 price target on Domino's shares. This represents almost 52% upside from the company's current share price of $40.21.

Motley Fool contributor James Mickleboro owns shares of Domino's Pizza Enterprises Ltd.

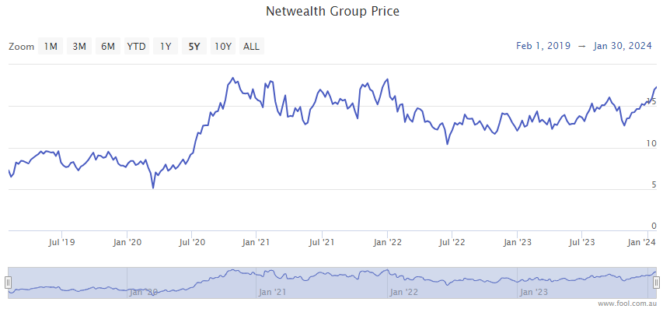

Netwealth Group Ltd

What it does: Netwealth is a diversified fintech company. Its platform provides portfolio administration, investment management tools, and investment and managed account services to financial advisers, private clients, and companies.

By Bernd Struben: The Netwealth share price is up 31% over the past 12 months, and I believe there's more outperformance ahead.

The company recently reported that its member accounts grew by 3,254 in the December quarter to reach 132,826 accounts at the close of 2023.

As at 31 December, Netwealth had $78.0 billion of funds under administration (FUA). That was achieved following record 12-month FUA inflows of $19.7 billion.

Atop the potential capital gains, Netwealth shares trade on a 1.4% fully-franked trailing dividend yield.

And CommSec estimates that both the company's earnings per share (EPS) and dividend payouts will increase over each of the next three calendar years.

Motley Fool contributor Bernd Struben does not own shares of Netwealth Group Ltd.