The Tesla Inc (NASDAQ: TSLA) share price has fallen 20% over the past month while the Nasdaq Composite Index (NASDAQ: .IXIC) has lowered 3.4%.

Unease among shareholders has spread following the electric vehicle (EV) automotive company's lacklustre third-quarter figures released nearly two weeks ago. Some investors are considering whether the company truly deserves its premium valuation at a price-to-earnings (P/E) ratio of 64 times.

Why the sudden reassessment by shareholders?

Cause for concern

A heightened shakiness to the Tesla share price has arrived following the automaker's quarterly results. While total vehicles produced and delivered experienced growth compared to the prior corresponding period — increasing 18% and 27%, respectively — the same couldn't be said on the financial side.

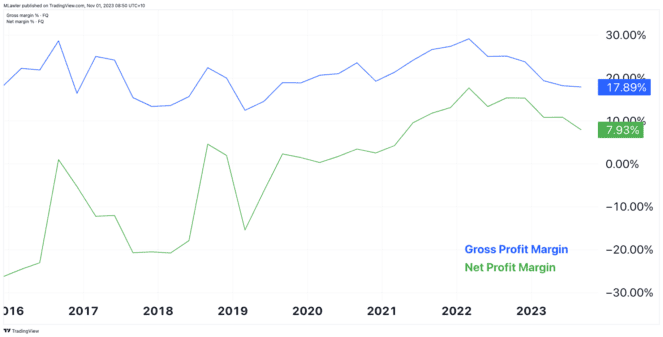

Total revenue for Tesla ratcheted up 9% year on year, a dramatic slowdown from the 47% rise presented in the previous quarter. However, the real turmoil appears to have reverberated from the company's dwindling gross margin.

As depicted above, Tesla's gross profit margin fell to 17.9% in Q3. The company reported a much more robust 25.1% margin only a year earlier. However, the US-based EV maker has since slashed prices to sustain demand amid higher interest rates and tightened consumer spending.

The worry is whether Tesla might be no different to traditional automakers, such as Ford Motor Co (NYSE: F) and General Motors Co (NYSE: GM), in light of its recent unremarkable margins.

Reportedly, the recent share price weakness has been driven mainly through institutional selling. One analyst less enthused by Tesla following its third quarter is Wedbush Securities' Dan Ives, trimming his price target from US$350 to US$310.

A win for the Tesla share price

On a positive note for the company, news broke overnight of Tesla winning a US trial scrutinising its driver-assist autopilot feature.

An accident occurred in 2019 involving a Tesla Model 3, resulting in the death of the driver. The two surviving passengers alleged the autopilot functionality was knowingly defective, causing the lethal incident.

Last night, a jury determined the vehicle was not defective, clearing Tesla of any wrongdoing. The ruling is an important one for keeping a high-margin future alive. The company has long heralded its self-driving capabilities as a significant profit centre down the track.

The Tesla share price strengthened 1.8% to US$200.84 overnight.