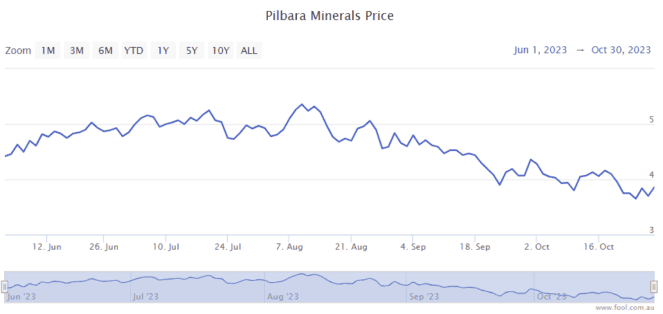

The Pilbara Minerals Ltd (ASX: PLS) share price has been headed lower over the last few months, as we can see on the chart below. Looking at the outlook for November and onwards, is it a buy considering conditions for the ASX lithium share have worsened?

Since 10 August, the Pilbara Minerals share price has sunk close to 30% and is getting close to its 2023 low.

What's happening to the Pilbara Minerals share price?

There are two important things that influence revenue and profit.

The amount of lithium production plays a key role and the lithium price is important too.

In the first quarter of FY24, the business said that both of its numbers had gone back significantly. Production of spodumene concentrate was down 11% year over year to 162.8kt and the realised price for its lithium was down 31% year over year to US$2,240 per tonne.

The negative combination meant that Pilbara Minerals' revenue sank 42% to A$493 million. Yet, its unit operating costs increased 19% to A$747 per tonne.

Pilbara Minerals said, regarding the lithium price, that "market pricing for spodumene concentrate and lithium chemicals is however likely to continue to remain volatile in the near-term given uncertain macroeconomic conditions and closely managed inventories in the supply chain."

But, the company is still positive for the future:

The long-term outlook for lithium markets supply remains positive with an expected structural deficit of lithium materials supply relative to the expected demand for lithium-based products such as electric vehicles and battery energy storage.

Is the ASX lithium share an opportunity?

I think it's a good idea to expect that the lithium price and the Pilbara Minerals share price will be volatile, like it has been over the past few years.

Pilbara Minerals has made a lot of profit over the last couple of years and it now has over $2 billion of cash on the balance sheet. It can invest a lot into its future thanks to that cash, with the business looking to significantly increase its production over the next couple of years.

I think that the ASX lithium share is facing uncertainty in the short term but has a compelling longer-term outlook with the growing demand for lithium across electric vehicles, home batteries, large-scale industrial batteries and so on.

I don't know when or if the lithium price is going to rise again, but it's this landscape of weaker conditions that can provide us with better value.

If the business is able to deliver on its projected earnings per share (EPS), then it's on a single-digit price/earnings (P/E) ratio. The earnings estimate on Commsec suggests it could generate 41.8 cents of EPS, which would put the Pilbara Minerals share price at 9 times FY24's estimated earnings.

In terms of the passive income, it could pay a grossed-up dividend yield of 4% in FY24.

I may become a shareholder myself before the end of November.