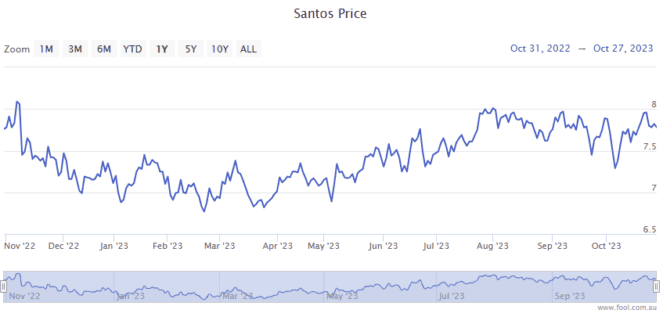

Santos Ltd (ASX: STO) shares have lost 2.5% since the last day of trading in September.

The S&P/ASX 200 Index (ASX: XJO) oil and gas stock is sliding in intraday trading on Monday, down 1.7% to $7.70 a share.

For some context, the ASX 200 is down 0.5% today. Though Santos shares have fared better so far in October, with the benchmark index down 3.6% since the closing bell on 29 September.

Of course, that's all in the rearview now.

With November fast approaching, what can ASX 200 investors expect from Santos shares in the month ahead?

What's ahead for the ASX 200 energy producer?

I won't speculate on the monthly share price moves. However, there are a few major factors at play that could impact Santos shares in November.

The first is broader investor sentiment.

While that sentiment is also impossible to accurately gauge a month ahead of time, sentiment in Santos shares looks to have gotten a boost following the company's September quarter production update.

Among the highlights, Santos reported a quarter on quarter uptick in sales revenue, which came in at US$1.4 billion for the three months.

As for free cash flow from operations, an important metric to keep an eye on, Santos had achieved year to date free cash flow of US$1.6 billion as at 30 September.

Santos CEO Kevin Gallagher said that "positions the company well to deliver shareholder returns, backfill and sustain our existing business, while also investing in our major projects and progressing our decarbonisation plans".

Another big influence on Santos shares is the oil and gas price.

Brent crude oil was trading for US$95.31 a barrel on 29 September before dropping to US$84.07 per barrel on 5 October. Today Brent is trading for US$89.84 per barrel. That's down 0.8% overnight amid hopes that Israel's ground incursion into Gaza could be contained and not ignite the broader region.

With more than 30% of global oil produced in the Middle East, any major escalation in hostilities could lead to a sharp spike in the oil price. Particularly if transport via the narrow Strait of Hormuz, a crucial shipping lane, is disrupted.

Commenting on the outlook for global oil markets – and by connection Santos shares – Giovanni Staunovo, a commodity analyst at UBS Group said (quoted by Bloomberg), "Concerns that the war may spill over into a broader regional conflict, with the potential to disrupt oil supplies, do raise the upside risks to oil prices."

How have Santos share been tracking?

Santos shares have been strong performers in 2023, up 9% year to date.