I love investing in S&P/ASX 300 Index (ASX: XKO) stocks that have long-term growth potential and have gone through a dip. They can be opportunities because of the better value on offer. In this article, I'm going to talk about Australian Ethical Investment Ltd (ASX: AEF) shares – I'm planning to buy some in November.

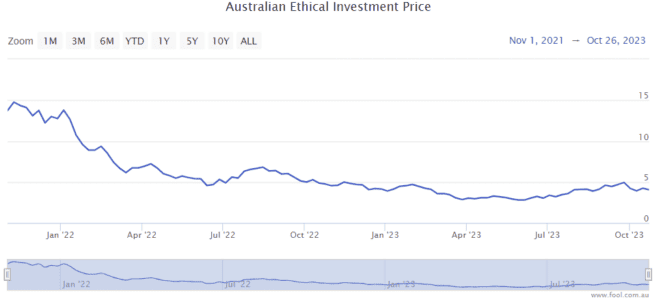

As we can see on the chart below, the Australian Ethical share price has fallen by over 70% since November 2021 and it's down over 20% from 25 September 2023.

The heavy fall is why I'm looking at investing next week/month, but there are a few things that are attracting me to the ASX 300 stock.

Ongoing net inflows

One of the most important statistics for a fund manager is the funds under management (FUM) – how much money the fund manager is looking after.

Good investment performance can help FUM growth, but the direction of net flows is important too. Is more money flowing into the fund manager than what people are taking out? It's easy to grow FUM if money is coming in, but it's a real headwind if money is constantly coming out, in net terms.

Australian Ethical offers superannuation, which is a great tool for the fund manager to attract regular and long-term superannuation contributions.

In the three months to September 2023, it reported $114 million of positive net flows, thanks to superannuation net flows of $117 million.

As long as the net flows stay positive, it seems like the company has a positive future.

Customer growth

The company can benefit from net flows from its existing customers, but the business can also expand by growing its number of customers, which can lead to future net flows and a boost for FUM.

This ASX 300 stock finished FY23 with 127,000 customers at June 2023. It had grown to 129,000 by the end of September 2023, so it was an increase of around 1.6% quarter over quarter.

Becoming a bigger business can help a number of financial metrics, including revenue, which is the top of the waterfall of profitability. In FY23, overall revenue increased 15% to $81.1 million, while second-half revenue rose 22%. It's targeting annualised revenue of $100 million by the end of FY24.

Future profit growth

The business is looking to invest heavily to drive future growth, while also "delivering further operating leverage" as it aims to reduce its cost-to-income ratio. It's expecting "solid profit growth in FY24."

I think fund managers can be very scalable. That means, that as they grow in size, their profit margins can increase.

A fund manager doesn't necessarily have to hire a new person every time they manage an extra $100 million. New revenue can help profit grow at a faster rate than revenue growth.

As the ASX 300 stock grows in size, it can use its larger size to invest for growth and/or pay larger dividends. In FY23 it grew its annual dividend per share by around 17%.

As the business grows its FUM, I believe profit can keep climbing, which could be helpful for the Australian Ethical share price.