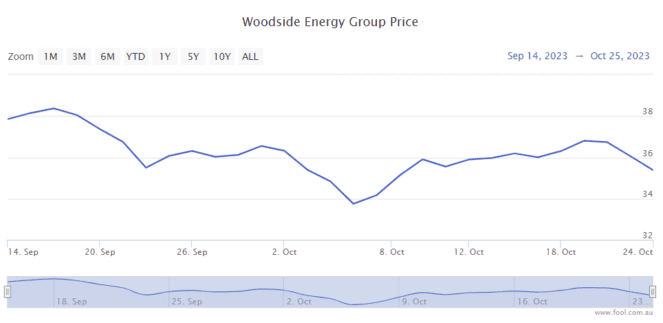

The Woodside Energy Group Ltd (ASX: WDS) share price has fallen 6% in a week and it's down close to 10% from 15 September 2023, as seen on the chart below. The S&P/ASX 200 Index (ASX: XJO) has fallen by around 6% since 15 September 2023, so Woodside has underperformed but the market has dropped as well.

What happened recently?

Woodside doesn't have a lot of control over energy prices, but it can do its best operationally to produce a lot at a relatively low cost.

The company recently released its quarterly update for the three months to September 2023.

It said that it produced 47.8 million barrels of oil equivalent (MMboe) for the quarter, up 8% from the second quarter of 2023 after the completion of planned turnaround and maintenance activities.

The company achieved sales volume of 53.3 MMboe, up 10% on the second quarter of 2023, primarily due to higher production.

It delivered revenue of $3.26 billion of revenue, which was up 6% from the second quarter of 2023 – higher production was offset by lower realised prices. It achieved an average realised price of $60.2 per barrel of oil equivalent (BOE).

According to reporting by The Australian, the International Energy Agency (IEA) has said that the price of LNG is forecast to fall because of a significant increase in new projects coming online from 2025 onwards. This could lead to an addition of more than 250 billion cubic metres per year of new capacity by 2030, which is reportedly equivalent to around 45% of the current total global LNG supply. This could become a headwind for Woodside shares.

At the same time as all of this extra supply comes online, the IEA is projecting that there will be slowing demand for fossil fuels. Coal, oil and gas are expected to fall to 73% of global energy by 2023, down from 80%.

As one of the largest LNG producers in Australia, this could have a negative impact on the company. However, and this is my own devil's advocate point, it's possible that coal and perhaps oil may see more of a decline than gas because of the bad reputation that coal has, and the shift to electric vehicles away from oil.

Is the Woodside share price a buy?

The ASX energy share is an interesting opportunity considering it has fallen, but its success is highly linked to energy prices, which are notoriously difficult to predict.

Woodside is working on bringing online more projects, but this could harm energy prices, so it's treading a path where it needs to balance growth and energy prices.

The Woodside share price is flat over the past year, but it's still higher than where it was in 2021.

I don't think it has fallen enough to be a buy, and the potential for lower energy prices in the future is a potential headwind.

If I were going to invest in an ASX resources share, I'd rather go for something related to decarbonisation where there's a long-term demand growth forecast, rather than an oil and gas stock where the world wants to move away from those commodities in the longer term.