Since the end of July 2023, the Nasdaq Composite (INDEXNASDAQ: .IXIC) has dropped by 10.6%, so it has entered correction territory.

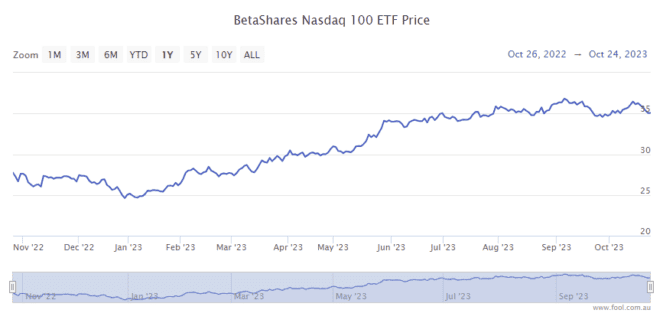

The Betashares Nasdaq 100 ETF (ASX: NDQ) has also fallen during that period, as we can see on the chart below. So could this be the right time to buy the US-focused investment?

Readers may know that the job of an exchange-traded fund (ETF) is to invest in a portfolio of assets (usually shares). The ETF's returns should match the returns of the underlying businesses minus the costs of operating the ETF.

Changes in foreign exchange rates can also have an effect. If the exchange rate between the US and Australian dollar changes, the return of something like the NDQ ETF will be different in Australian dollars compared to the return in US dollars.

That's partly why the Betashares Nasdaq 100 ETF is down by only 3.5% since the end of July 2023 because the Australian dollar has weakened, cushioning Aussie investors from some of the decline.

Is this a good time to invest in the NDQ ETF?

Based on the quality of its underlying company holdings, I'd say it's a good time to invest in this ETF most of the time.

The businesses I'm mostly talking about are big names like Microsoft, Amazon.com, Alphabet, Apple, Meta Platforms and Nvidia. Remember, though, the portfolio comprises a total of 100 company holdings, so there's good diversification.

These tech giants have so much potential for further earnings growth in areas globally like digitalisation, cloud computing, artificial intelligence, video gaming, online video, digital advertising, smartphones and so on.

When a business has a strong long-term future, being able to buy at a cheaper price is attractive. However, the NDQ ETF is still up by almost 40% in the year to date, and it's near its all-time high. At this level, I definitely wouldn't call it cheap.

The weaker Australian dollar also makes it a bit more expensive to buy US shares, though currency doesn't need to be a primary consideration.

I'm also wary of some tech share valuations in the NDQ ETF, considering interest rates are quite high now (compared to the last 15 years). And I believe they are likely to stay high for longer than some people expect. Warren Buffett's comments about interest rates being like gravity spring to mind – higher rates are meant to pull down on asset prices, in theory.

In my mind, the NDQ ETF is still an excellent investment, and I'd be happy enough to buy a few units today at this lower price. However, I'd wait for a better price/lower interest rate to invest a larger sum.