The Fortescue Metals Group Ltd (ASX: FMG) share price is down 0.6% today.

Shares in the S&P/ASX 200 Index (ASX: XJO) iron ore miner closed yesterday trading for $22.02. In Thursday morning trade shares are swapping hands for $21.89 apiece.

For some context, the ASX 200 is also down 0.6% at this same time.

This comes following the release of Fortescue's quarterly update for the three months ending 30 September.

Read on for the highlights.

Fortescue share price dips on shipping slowdown

The Fortescue share price has dipped into the red after the ASX 200 miner reported 45.9 million tonnes (Mt) of iron ore shipments, down 3% year on year.

On the cost front, the company incurred a Pilbara Hematite C1 cost of US$17.93/wet metric tonnes (wmt). That's up 1% from Q1 FY23.

Pilbara Hematite average revenue came in at US$100/dry metric tonne (dmt) over the three months.

The quarter gone by also saw Fortescue's Iron Bridge project commence production, achieving its first shipment of high-grade magnetite concentrate.

And the miner completed its acquisition of the Phoenix Hydrogen Hub in the United States, the potential location for an 80MW electrolyser and liquefaction facility.

As at 30 September Fortescue had a cash balance of US$3.1 billion, down from US$4.3 billion held at 30 June 2023. The miner had a net debt of US$2.2 billion at 30 September after paying out its US$2 billion final dividend alongside investments of US$764 million.

What did management say?

Commenting on the quarterly results that have yet to lift the Fortescue share price, CEO Dino Otranto said:

It's been a solid quarter for the metals business with shipments of 45.9 million tonnes contributing to the significant milestone of two billion tonnes shipped since we commenced operations. We started our business just 20 years ago, commenced full-scale operations 15 years ago and reached one billion tonnes of iron ore shipped less than six years ago.

Fortescue Energy CEO Mark Hutchinson added:

We are on track with progressing our green energy projects and executing our decarbonisation roadmap. Our battery electric haul truck prototype is being tested at our Chichester Hub and we have also received the first T264 haul truck from Liebherr which signifies the start of the conversion of our fleet to zero emissions.

What's next?

Looking at what could impact the Fortescue share price in the months ahead, the miner maintained its previous FY 2024 guidance. Management forecasts iron ore shipments of 192 to 197 million tonnes with a C1 cost for Pilbara Hematite of US$18.00 to US$19.00/wmt.

Metals capital expenditure is expected to be in the range of US$2.8 to US$3.2 billion. And energy net operating expenditure is forecast to be US$800 million, with capital expenditure and investments of around US$400 million.

Fortescue share price snapshot

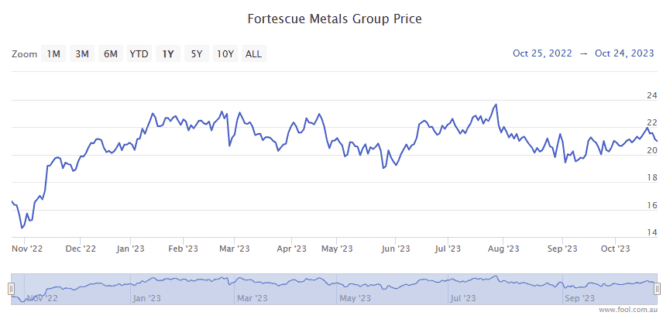

The Fortescue share price has seen some strong growth over 12 months, up 36% since this time last year, when iron ore prices were below US$90 per tonne.