Investors in one particular ASX technology stock are partying on Wednesday after the share price disappeared into outer space to the tune of 160%.

Small-cap stock Damstra Holdings Ltd (ASX: DTC) closed Tuesday at 10 cents, but at the time of writing on lunchtime Wednesday, it is flying at 26 cents.

What's going on here?

US suitor makes Godfather offer

The excitement is all from news that Damstra has received a takeover bid from a US suitor.

The ASX company revealed coming out of a trading halt that privately owned Texan business Mitratech Holdings Inc has proposed to acquire all Damstra shares at 30 cents cash.

At the moment it remains just a proposal, but Mitratech has been granted four weeks of exclusive due diligence.

"The proposal is non-binding and highly conditional," Damstra stated to the ASX.

"There is no certainty that any binding transaction will proceed or eventuate as a result of the proposal."

Not an easy ride for this ASX tech stock

Damstra makes software for clients in industries that need to manage workplace safety and regulatory requirements.

While Wednesday's share price movements are undoubtedly fantastic for its shareholders, it's merely a small relief for long-term investors.

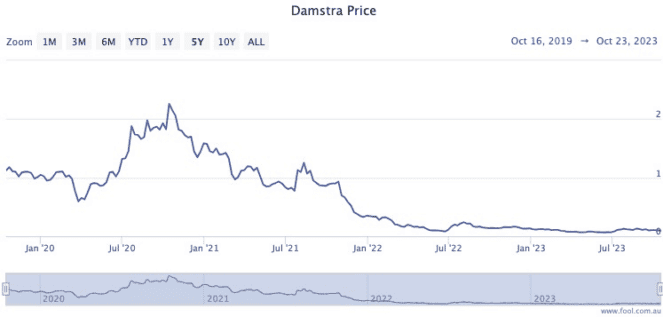

The company listed on the ASX in October 2019 after selling shares at 90 cents at its initial public offering (IPO).

After climbing to $2.19 one year later, Damstra shares have tumbled 89% in the midst of the growth stock sell-off.

There is currently no analyst coverage of the $65 million ASX tech stock on CMC Markets.