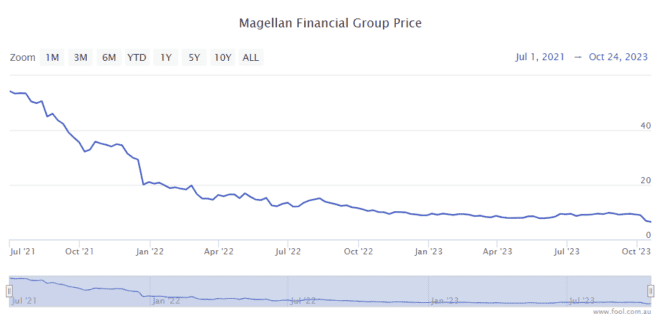

The Magellan Financial Group Ltd (ASX: MFG) share price has been through a really rough time. In the past month, it's down 30% and since the start of FY22, it has dropped over 80%, as we can see on the chart below. Ouch.

For Magellan, the key difficulty has been that funds under management (FUM) have flowed out through the door for a couple of years with little sign that they are going to stop soon.

Earlier this year, there were promising signs that its important international shares strategy was starting to deliver outperformance. But, the last few months have seen sizeable declines and underperformance against the global benchmark again.

Could the Magellan share price keep dropping?

Philippe Bui from Medallion Financial Group recently wrote on The Bull that he thought that the fund manager was still a sell because it's still seeing fund outflows at an "aggressive rate".

In Magellan's monthly update for September 2023, the fund manager revealed that its total FUM had fallen from $39 billion to $35 billion in just one month. The troubled fund manager said that it experienced net outflows of $2 billion, which included net retail outflows of $0.3 billion and net institutional outflows of $1.7 billion.

Medallion Financial Group believes that Magellan may be subject to further pressure if the Magellan Global Fund (ASX: MGF) is converted from a closed-ended fund into an open-ended exchange-traded fund (ETF) after engaging with activist investor Nick Bolton.

The board of Magellan recently said that it was considering a conversion of the closed class units into open class units as this should, if implemented, permanently address the trading discount between the net asset value (NAV) and the share price.

However, Magellan said that a conversion "raises considerable complexities requiring significant work to address and Magellan will have regard to legal, regulatory and tax matters that require detailed assessment."

Magellan said that it expects to update members of the fund as the conversion proposal is developed and once it is in the position to provide further details, with a unitholder meeting targeted for the first half of the 2024 calendar year.

Other ratings

Analysts are mixed on the business. According to the analyst ratings collated by Factset on the Magellan share price, there are two buy ratings, five hold ratings and three sell ratings at the current Magellan share price, despite the company being priced much cheaper.

Investors don't think this is much of an opportunity.