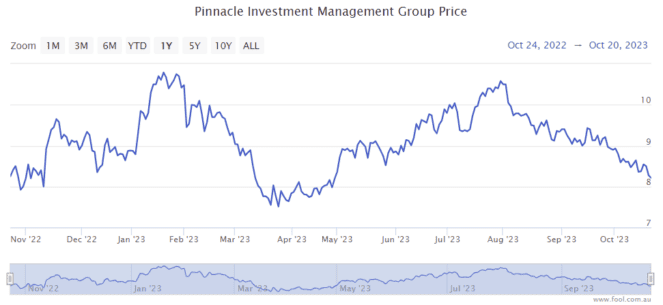

The Pinnacle Investment Management Group Ltd (ASX: PNI) share price is hurting, down 24% from 1 August 2023, as we can see on the chart below.

The S&P/ASX 200 Index (ASX: XJO) share looks like an opportunity in my opinion. This business invests in 'affiliates' (fund managers) and it also provides seed funding, global institutional and retail distribution, and "industrial grade" middle office and infrastructure services.

Pinnacle says that by providing its affiliates with "superior non-investment services", it enables them to "focus on delivering investment excellence to their clients."

Much cheaper valuation

With the Pinnacle share price down significantly, its valuation looks very attractive to me.

It's understandable why the market is fearful about fund managers at the moment. As share market conditions change, fund managers can see stronger swings – rising asset prices help funds under management (FUM) and can help attract investor money. A decline in asset prices hurts FUM and may lead to investors delaying investing.

Despite all of the volatility, FY23 was a solid year considering the headwinds. Net profit after tax (NPAT) grew slightly to $76.5 million and the annual full-year dividend increased 3% to 35 cents per share.

According to the estimate on Commsec, the business is projected to generate earnings per share (EPS) of 42.3 cents. That would put the Pinnacle share price at 19 times FY24's estimated earnings.

Net inflows turn around

One of the key factors for a fund manager is the net inflow performance. If money is flowing out, then the ASX 200 share needs to generate more investment performance just to offset that, let alone achieve FUM growth.

In FY23, it achieved net inflows of $1.5 billion, with $3.1 billion of net inflows for the six months to 30 June 2023. This shows that there was a turnaround of net inflows in the second half of FY23. I think this bodes well for FY24 and beyond and could help the Pinnacle share price.

Further growth of investment options

Pinnacle can experience growth in a number of different ways. It is expanding with new affiliates, strategies, channels and geographies which can provide new levers for expansion.

The ASX 200 share says that international distribution is emerging as an engine of growth thanks to an organic, multi-year build-out of global investor networks, strategies and infrastructure.

There is a lot of growth potential with northern hemisphere distribution hubs, fiduciary outsourcing and 'virtual' due diligence bridging the gap between Australian-based Pinnacle affiliates and the world's largest pools of capital.

Strong dividend from the ASX 200 share

Regardless of what happens to the Pinnacle share price in the short term, the company continues to pay a solid dividend.

It has increased its dividend almost every year since 2016 aside from 2020 when it maintained its dividend, which is an impressive record considering that period includes the COVID-19 disruption.

On Commsec, Pinnacle is projected to pay an annual dividend per share of 36.5 cents in FY24 and 42.2 cents per share in FY25. At the current Pinnacle share price, that would imply a grossed-up dividend yield of 6.4% and 7.5% in FY25, respectively.