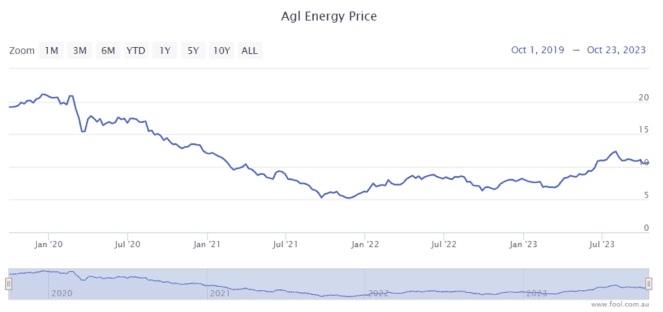

Owners of AGL Energy Ltd (ASX: AGL) shares have been through plenty of pain over the last four years, as we can see on the chart below. It's still more than 40% lower than where it was before.

The AGL share price and profit are on the rise. Could there also be a positive outlook for the AGL dividend as well?

Let's have a look at the potential dividend income.

AGL dividends

In FY23, the company generated underlying earnings before interest, tax, depreciation and amortisation (EBITDA) of $1.36 billion (up 12%) and underlying net profit after tax (NPAT) of $281 million (up 25%).

The ASX energy share said that from the FY24 interim dividend payment, AGL will be targeting a dividend payout ratio of between 50% to 75% of underlying profit after tax.

The AGL board of directors decided to declare a final dividend for FY23 of 23 cents, bringing the full-year dividend to 31 cents per share. At this stage, the dividends are unfranked, though a period of sustained profitability could mean the company is able to attach franking credits again to the dividends.

According to the estimate on Commsec, the company could pay an annual dividend per share of 53 cents in FY24 and 62 cents in FY25.

That would translate into an unfranked dividend yield of 5% in FY24 and 5.8% in FY25.

The broker UBS thinks that owners of AGL shares could get even bigger payments, with an annual payout of 55 cents per share in FY24 and 62 cents per share in FY25. That would be future yields of 5.15% and 5.8% in FY25 at the current AGL share price.

Positive outlook for earnings

In FY24, the company is expecting underlying net profit after tax of between $580 million and $780 million – this implies that profit could at least double, and if it does well it could get close to tripling.

The company's guidance reflects "sustained periods of higher wholesale electricity pricing, reflected in pricing outcomes and reset through contract positions."

It also reflects "expected improved plant availability and flexibility of the asset fleet, including the commencement of operations of the Torrens Island and Broken Hill batteries, and the non-recurrence of forced outages and market volatility impacts from July 2022."

This is forecast to be partly offset by the closure of Liddell Power Station and higher operating costs.

Higher profit may well be supportive for the AGL share price and AGL dividend.