Two ASX lithium shares have been given a boost today thanks to brokers upgrading their ratings on the companies. The ones we're talking about are Pilbara Minerals Ltd (ASX: PLS) shares and Liontown Resources Ltd (ASX: LTR) shares.

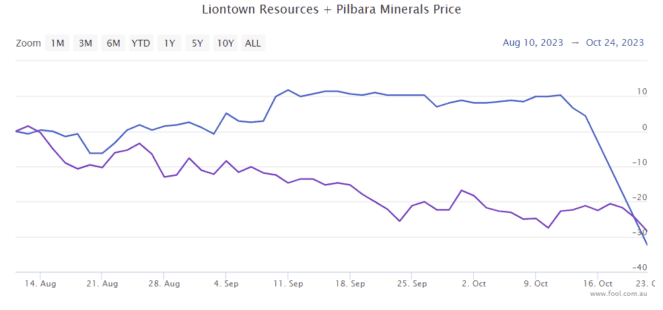

Both companies have been through a lot of volatility in recent weeks. The Liontown share price suffered a crash when Albemarle walked away from its acquisition attempt, while Pilbara Minerals is suffering from market malaise. Just look at the pain on the chart below.

Liontown Resources upgrade

According to reporting by The Australian, the broker Wilsons has upgraded its rating on the ASX lithium share Liontown Resources.

Wilsons has increased its rating on the ASX mining share to overweight, which essentially means buy.

The Australian reported on comments by Wilsons that the $367 million capital raising at $1.80 per share was bigger than expected.

Liontown Resources also announced that it had signed a commitment letter and approved term sheet with a syndicate of leading international and domestic commercial banks and government credit agencies for an A$760 million debt funding package on "very attractive commercial terms and includes long duration project finance facilities and an optional cost overrun / working capital facility."

The Australian reported on what the analysts said in a note about the ASX lithium share:

The equity raise priced at a discount to prior trading levels ($2.79 per share) was

significantly larger than we had previously anticipated, given the amount of capital the company has raised is significantly in excess of what previous company indications were for its requirements.The key difference is the $350m-odd liquidity and cost overrun buffer which the

company has chosen to allow for.

The Liontown Resources share price remains down by around 40% from 10 October 2023.

Pilbara Minerals shares upgraded

According to The Australian, The ASX lithium share was raised to a buy by the broker Jarden Securities.

This comes after the company's 30% decline since 10 August 2023.

My colleague James Mickleboro recently wrote a piece on what investors may see from Pilbara Minerals' upcoming quarterly update for the three months to September 2023.

The ASX lithium share should tell investors about how much lithium it produced, how much it sold, its costs and what it sold its production for. This could have a significant impact on the Pilbara Minerals share price if it's much better or worse than what the market was expecting.