The Weebit Nano Ltd (ASX: WBT) share price is surging today, up 17.6%.

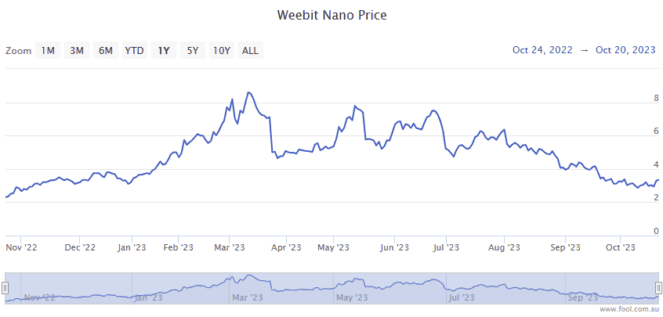

Shares in the S&P/ASX 200 Index (ASX: XJO) tech stock, which develops advanced memory technologies for the global semiconductor industry, closed on Friday trading for $3.76. At the time of writing on Monday, shares are swapping hands for $4.72 apiece.

For some context, the ASX 200 is down 0.8% at this same time.

Here's what's driving investor interest today.

Weebit Nano share price riding high on commercialisation news

The Weebit Nano share price is having another stellar day after closing up 6.8% on Thursday and gaining another 13.3% on Friday.

ASX 200 investors who bought the stock this time last month will now be sitting on gains of 30%. Shares are up an impressive 87% over the past 12 months.

Today's strong gains look to be connected to ongoing enthusiasm over Thursday's announcement of a commercial agreement with South Korean foundry DB HiTek.

As The Motley Fool reported on Thursday, "DB HiTek has licensed the company's memory technology, Weebit Resistive RAM (ReRAM), for its customers to integrate as embedded non-volatile memory (NVM) in their systems on chips (SoCs)."

Investors quickly sent the Weebit Nano share price higher on the news, although the company stressed that it was unclear how much revenue it might earn from the agreement "due to the contingent nature of the license fees and royalties".

Revenue will depend on how many customers sign up to use Weebit's memory tech, as well as on how many chips are then produced using that technology.

Weebit CEO Coby Hanoch highlighted the potential growth from the agreement.

According to Hanoch:

As one of the world's largest contract chip manufacturers, DB HiTek's extensive customer base can gain significant advantage from using Weebit ReRAM in their new product designs, including improvements to retention, endurance, and power consumption.

Looking ahead, Hanoch said, "We are seeing increasingly strong market demand for Weebit ReRAM and expect to sign further commercial agreements."

Judging by the fast-rising Weebit Nano share price, investors also look to be pricing in those further agreements.