Australia and New Zealand Banking Group Ltd (ASX: ANZ) shares have dipped into the red today, mirroring the modest losses posted by the other big four Aussie banks.

Shares in the S&P/ASX 200 Index (ASX: XJO) bank stock closed Friday trading for $25.27. At the time of writing on Monday, ANZ shares are changing hands for $25.22 apiece, down 0.2%.

For some context, the ASX 200 is down 0.8% at this same time.

That's today's price action for you.

Now here's why the Queensland government is backing ANZ's acquisition of the banking arm of Suncorp Group Ltd (ASX: SUN).

Queensland eyes major lending commitments

If you own ANZ shares, you're likely aware of the bank's ongoing merger aspirations with Suncorp Bank. The $4.9 billion deal would expand ANZ's footprint in the Aussie mortgage market while leaving Suncorp free to focus entirely on its insurance business.

But the deal has run into significant red tape.

On 4 August the Australian Competition and Consumer Commission (ACCC) announced it would block the merger. The ACCC cited concerns that the deal would decrease competition for home loans across Australia. The ACCC also said it could negatively impact small to medium enterprise banking and agribusiness banking in Queensland.

But ANZ and Suncorp have not been deterred.

ANZ filed an application with the Australian Competition Tribunal to review the ACCC's decision on 25 August.

While that review has yet to be completed, ANZ shares could be moving closer to incorporating Suncorp Bank following support from the Queensland government.

Queensland officials have expressed concern that thousands of jobs and $15 billion in new lending could be lost if the merger is derailed.

ANZ CEO Shayne Elliott had previously noted that management believes "the acquisition will improve competition, which will benefit Australian consumers, particularly in Queensland".

In a statement over the weekend (quoted by Sky News), Elliott said Queensland was "thriving with strong opportunities to further grow and prosper."

He added that the bank remains "excited about the benefits of bringing Suncorp Bank and its customers into the ANZ group".

How have ANZ shares been tracking?

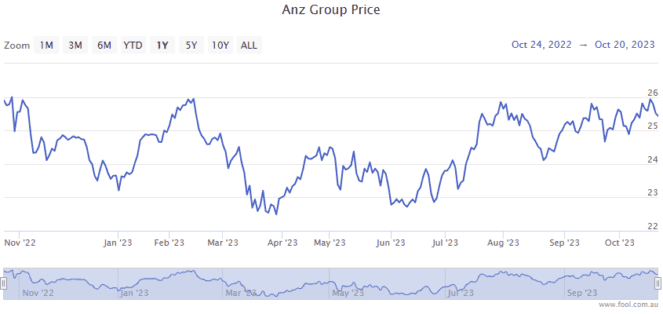

ANZ shares have outperformed the benchmark in 2023, gaining just under 10%.