Exchange-traded funds (ETFs) on the ASX offer investors plenty of positives, depending on what you're looking for.

I'm heavily invested in ASX shares, directly and indirectly. It'd be good to get some diversification. So, I like the look of investment options that can give me access to businesses and investment themes that I can't access on the ASX.

ETFs that are invested in global shares could be really interesting to Aussies. Below are two that I'm a fan of.

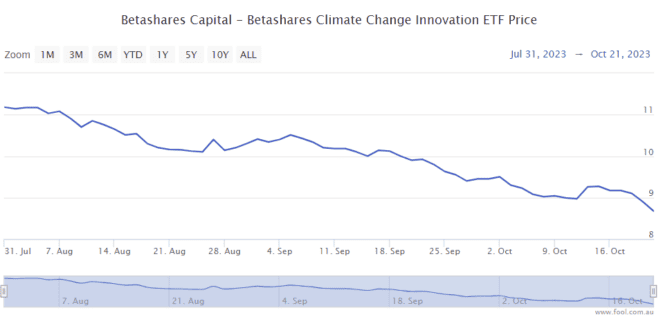

Betashares Climate Change Innovation ETF (ASX: ERTH)

The idea of this ASX-listed ETF is that it's invested in up to 100 global companies that make at least 50% of their revenue from products and services that help to address climate change and other environmental problems by reducing or avoiding CO2 emissions.

There is a broad range of sectors and solutions within this portfolio, including clean energy, electric vehicles, energy efficiency technologies, sustainable food, water efficiency and pollution control.

Some estimates put the cost of decarbonisation by 2050 at trillions of dollars. That's a huge price tag, but it can represent a large pool of potential revenue for the businesses that are enabling decarbonisation.

Some of the biggest positions in the portfolio at the moment include BYD, Cie De Saint-Gobain, Ecolab, American Water Works, Tesla, Vestas Wind Systems and East Japan Railway.

The ERTH ETF unit price has dropped more than 20% from 1 August 2023, as we can see on the chart below, so it could be a contrarian time to invest.

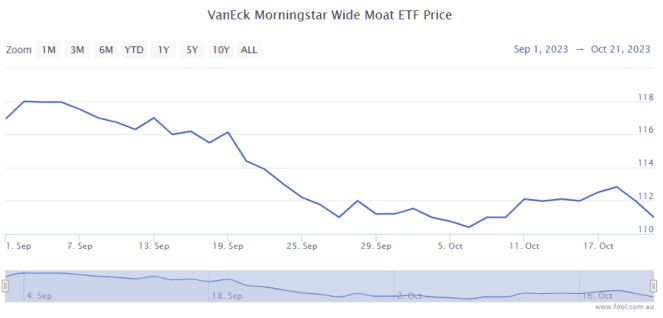

Vaneck Morningstar Wide Moat ETF (ASX: MOAT)

This is one of my favourite ASX-listed ETFs, not just because it has done really well but because of the investment style.

The concept of the MOAT ETF is that it invests in 'quality' US companies that Morningstar thinks has sustainable competitive advantages or wide economic moats.

Moat power can come in many different forms, such as brand power, patents, intellectual property, network effects and cost advantages.

However, the ETF portfolio only initiates a position in a business when it's trading at an attractive price compared to Morningstar's estimate of fair value.

Some of the biggest positions in the portfolio are currently Alphabet, Gilead Sciences, Comcast, Wells Fargo, Nike and Walt Disney.

Past performance is definitely not a guarantee of future performance, but the MOAT ETF has done very well. Over the last five years, the MOAT ETF has delivered an average return per annum of 14.1%, compared to a return of 11.9% for the S&P 500 Index (INDEXSP: .INX) in the same time period.

The ASX ETF's unit price has fallen 6% since 5 September 2023, so now could be a good time to look at this investment and buy the dip.