Diversification is absolutely critical in investing, experts keep saying to us.

This means not just buying into a variety of sectors, but looking at geopolitical diversity too.

So to add to your ASX shares, you may be considering buying some overseas stocks.

But naturally you don't have as much knowledge about other countries as you do for Australia.

The great news is that, to help you get started, the investment risk of various countries around the world was recently revealed.

Maybe that will guide you as to which offshore share markets you'd like to invest in:

How was the risk in each country calculated?

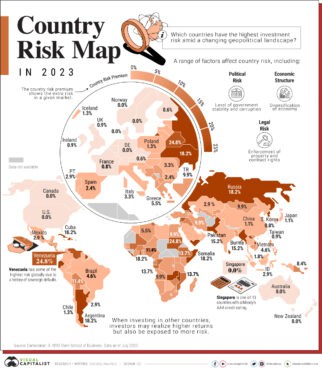

According to Visual Capitalist, New York University Stern School of Business professor Aswath Damodaran put each country through three broad criteria:

- Political risk: corruption, conflict

- Legal risk: contract rights, property rights

- Economic risk: diversification of activities

These factors were combined with the chances that the nation could default on its sovereign debt to come up with the total risk premium.

"When a nation defaults on its debt, it often leads to market turbulence, and other negative effects that can last for many years," said Visual Capitalist reporter Dorothy Neufeld.

The least riskiest nations to invest

The great news is that Australia was one of 13 nations that had the lowest risk, at 0% premium.

So if you already have ASX shares, that's an excellent start to the portfolio.

Other 0% risk nations included New Zealand, Canada, Singapore, and the United States. The share markets in those countries are accessible and popular with Australian investors.

The remaining eight countries are all in Europe: Denmark, Germany, Liechtenstein, Luxembourg, Netherlands, Norway, Sweden and Switzerland.

"This is due to factors such as their AAA-rated government bonds, low corruption, and strong property right protections."

The most riskiest countries to invest

What about the riskiest places in the world to invest?

Five countries tied for first with a 24.8% risk premium: Belarus, Lebanon, Venezuela, Sudan and Syria.

With the recent conflict breaking out with Israel, there are further alarm bells ringing for Lebanese shares.

"In Belarus, Russian military forces continue to operate. Venezuela has faced hyperinflation and endemic corruption for many years."