There was a major share sale involving an S&P/ASX 200 Index (ASX: XJO) share announced this week, relating to the retirement communities business Ingenia Communities Group (ASX: INA).

Ingenia describes itself as a leading operator, owner and developer of communities offering quality affordable rental and holiday accommodation focused on the growing seniors market in Australia. The business has over 100 communities across Australia.

ASX 200 share sale

If we look at the ASX announcement, there was a reported sale of 41,779,555 Ingenia shares on 12 October 2023 involving director John McLaren.

The share sale was done at $3.90 per Ingenia share, so the total proceeds were around $163 million.

However, it's important to remember that the shares indirectly held by Mr McLaren through Sun INA Equity LLC were beneficially owned by Sun Communities. Sun Communities is involved in acquiring, operating, developing and expanding manufactured home and RV communities since 1975.

Mr McLaren was appointed as the nominee director of Sun Communities, which was entitled to appoint a director to the board.

So, in reality, it was Sun Communities that was selling down its position, rather than an individual director.

JPMorgan was involved with the block trade.

There has been a lot of institutional trading in October. But, it appears that during this period (and amid the Sun Communities share sale), Canada Pension Plan Investment Board increased its holding by 4.5 million shares to around 25 million shares and the HMC Capital Ltd (ASX: HMC) group took its holding to 26.6 million shares.

Should investors be worried?

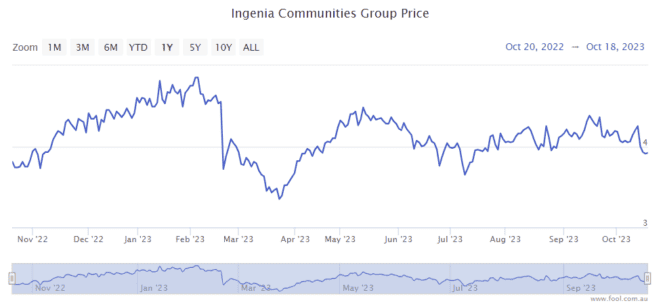

One institution selling and others buying doesn't need to be concerning, though the Ingenia share price is down around 10% over the past month, as we can see on the chart below. The ASX 200 share index has only dropped by 3.6% in the same time period.

In the FY23 result, Ingenia announced that there had been a seven-year extension of the development joint venture with Sun Communities.

A recent trading update by the ASX 200 share revealed that it had exchanged contracts to sell a 7.8 hectare block of land in Hervey Bay and the 2.4 hectare leasehold Broulee holiday park so that it could recycle its capital into existing communities under development, restock its development pipeline and manage gearing (debt).

A total of 79 homes settled in the first quarter of FY24. The residential communities are seeing strong demand and high occupancy, with the first quarter average rental uplift of more than 7.5% applied across six land lease communities and average rental growth of 8.5% across five of the group's all-age rental communities. Occupancy is close to 100%.

Residential market conditions "continue to slowly improve" thanks to demand and limited new supply.

The holidays business is seeing "strong trading", with forward bookings up 9% year over year.

All of these factors could be helpful for the ASX 200 share and for the Ingenia share price.