For sheer exhilaration as an investor, nothing beats seeing a small-cap stock you spotted before everyone else soaring to multi-bagger heights.

The analysts at NovaPort Smaller Companies Fund are specialists at ferreting out such gems.

As such, the team named three ASX shares that in the last quarter soared against a declining small-cap market, which they reckon have more gains to come:

An ASX monopoly

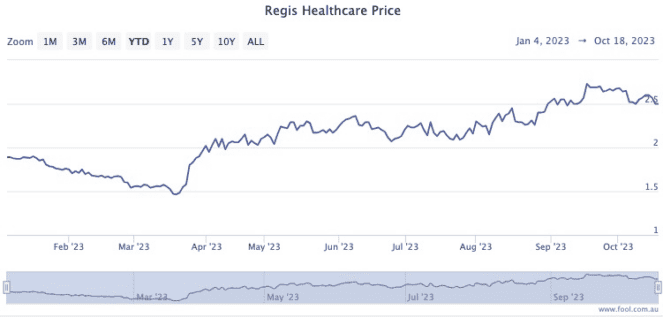

NovaPort analysts are bullish on aged care provider Regis Healthcare Ltd (ASX: REG) because it's about to become peerless on the ASX.

"With the takeover of Estia Health Ltd by private equity, Regis Healthcare will become the only listed aged care operator on the ASX for investors seeking exposure to the demographic growth and sector turnaround," they said in a quarterly report to clients.

As the report hinted, businesses involved in services for the elderly have potential structural growth built in because Australia's population is becoming older on average.

Regis Healthcare is also loved by other professionals.

According to CMC Markets, five out of seven analysts currently surveyed on CMC Markets label the stock as a buy.

The Regis share price has gained more than 70% since March, and 20% since July.

50% rise in 4 months!

It would be fair to say, in retrospect, November 2021 was one of the worst times for a software company to list on the ASX.

Unfortunately, SiteMinder Ltd (ASX: SDR) did precisely this.

For the first 18 months of its publicly listed life, the stock has had to deal with a massive sell-off of growth shares.

That's left the SiteMinder stock price 41.8% lower than its first-day closing price.

However, since 23 June, shares for the hotel e-commerce provider have enjoyed an almost 50% rise.

"SiteMinder's share price gains reflect the culmination of positive updates released over the last 12 months, which highlighted software subscriber growth, but not at the expense of additional cash burn."

It's full steam ahead for the transition to profitability.

"A strong top line, combined with cost saves, has seen timing expectations for cash flow break-even brought forward as the year has progressed."

A small-cap servicing many large caps

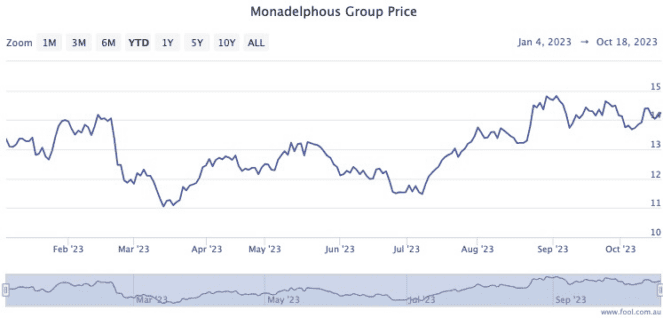

Monadelphous Group Ltd (ASX: MND) is not a household name, but the company does have a $1.37 billion market capitalisation.

The business provides engineering services for clients in the resources sector.

Ironically, the currently depressed global economy might improve Monadelphous' fortunes in the coming years.

"The robust outlook for capital expenditures across a range of commodities and sectors should fuel demand for Monadelphous' engineering services," read the NovaPort report.

"This improving demand outlook, and recent key contract wins, boosted the Monadelphous share price."

The share price has rocketed in excess of 22.7% since 26 June.

Monadelphous is well supported among the professional community, with six out of 10 analysts rating it as a buy on CMC Markets.