Small-cap shares suffered greatly during the period of 13 interest rate rises over 2022 and 2023.

But with inflation cooling and the prospect of rate cuts coming, the little guys are starting to play catch up to the medium and large caps.

Here are three ASX "penny stocks" that I think could break out above the 80 cent barrier in the future:

'More cleanup to be done in Australia' than anyone can handle

The first two stocks are both related to improving the environment, which is why I think they have a bright future.

Certainly in recent years nations around the world have become more conscious of damage to the planet, and both these companies provide solutions.

Environmental Group Ltd (ASX: EGL) is best described as an engineering firm that provides technologies to combat air pollution, water pollution, and produce energy from biowaste.

A couple of years back, Marcus Today founder Marcus Padley attested that landing work would be no trouble for Environmental Group.

"There is more cleanup to be done in Australia that EGL could possibly handle," he said.

"This is just a question of getting around the technology. It's not a question of finding things to do."

Both Bell Potter and Taylor Collison rate EGL shares as a strong buy currently, according to CMC Invest.

The analysts love these ASX penny stocks

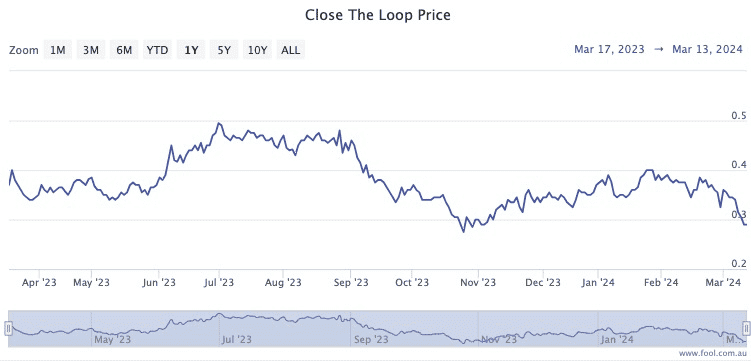

Close The Loop Ltd (ASX: CLG) provides take-back and recycling solutions that enable a circular economy.

Ink and toner cartridges are a major program, with batteries, cosmetics and soft plastics in its remit.

CMC Invest shows both Shaw & Partners and Unified Capital Partners rating the stock as a strong buy.

The Motley Fool's Tristan Harrison named it as one of the small caps he is intrigued by, as it is "growing revenue, improving margins and [has] appealing growth potential".

"I think quality smaller companies are capable of outperforming bigger businesses over the long term because their growth runways are longer."

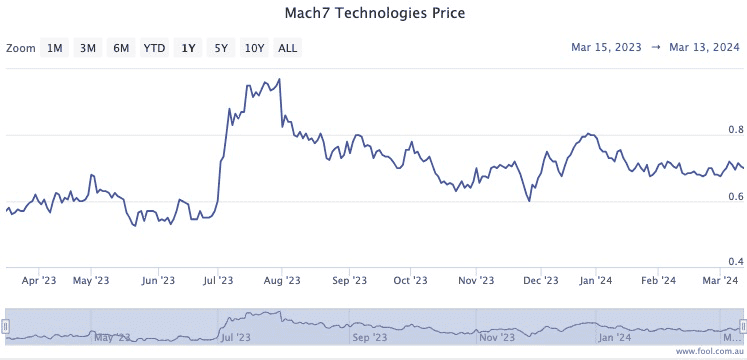

Meanwhile, Mach7 Technologies Ltd (ASX: M7T) creates management systems for medical images in hospitals.

All five analysts surveyed on CMC Invest are rating the healthtech stock as a buy, so it must be heading in the right direction.

Contract wins from big hospitals will be the catalyst for Mach7 shares to break through the 80 cent mark in the future.