The Credit Corp Group Limited (ASX: CCP) share price fell 32% to a new 52-week low of $11.655 as the market reacted to surprising news on Wednesday.

Here are the details.

Credit Corp share price plummets to new 52-week low

This morning, Credit Corp announced that it anticipates a more than 50% reduction in its FY24 profits.

This is due to an impairment of the carrying value of its US Purchased Debt Ledger (PDL) assets.

The company said the impairment will represent approximately 14% of the carrying value. It will likely show up in Credit Corp's interim financial statements for the period ending 31 December 2023.

The company estimates that the impairment will result in a one-off but substantial reduction in net profit after tax (NPAT) for FY24. As a result, the company has reduced its FY24 guidance.

Previously, the FY24 guidance issued in August was for statutory NPAT to fall within a range of $90 million to $100 million. This has been downgraded to a range of $35 million to $45 million.

Earnings per share (EPS) will be substantially lower, with guidance reduced from 132 cents to 147 cents to a range of 51 cents to 66 cents.

Why did this happen?

In a statement, Credit Corp told shareholders:

The impairment has arisen from a sustained deterioration in collection conditions. In releasing its FY2023 results on 1 August 2023 Credit Corp advised of increased US repayment plan delinquency over the final quarter.

These conditions have persisted throughout the first quarter of FY2024, prompting a reassessment of the medium-term outlook for collections on the Company's US PDL assets.

The purchasing cohorts most affected comprise of assets acquired in FY2022 and FY2023.

What now?

Thomas Beregi, CEO of Credit Corp, said that reduced market pricing should support the viability of continued purchasing.

Beregi said:

Prices at which the FY2024 US investment pipeline has been secured should deliver Credit Corp's target return in present conditions.

Credit Corp will provide a performance update at the annual general meeting next Tuesday, 24 October.

Credit Corp share price snapshot

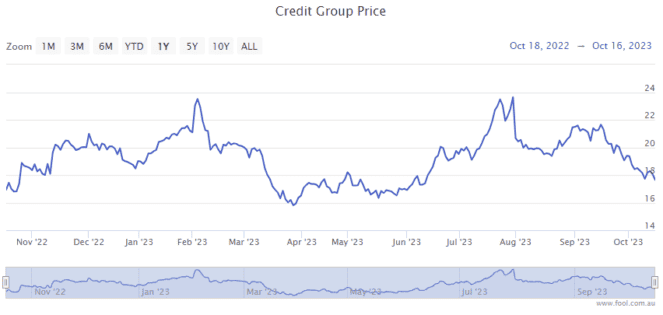

The Credit Corp share price has fallen 30% over the past year and is down 35% in the year to date.