The Whitehaven Coal Ltd (ASX: WHC) share price isn't going anywhere this morning.

Shares in the S&P/ASX 200 Index (ASX: XJO) coal stock closed yesterday trading for $6.79 apiece, up 1.2% for the week.

The Whitehaven share price entered a trading halt today at the company's request.

Management requested the trading halt pending an announcement relating to its proposed acquisition of the Daunia and Blackwater metallurgical coal mines, currently owned by the BHP Group Ltd (ASX: BHP) Mitsubishi Alliance. That announcement is expected before market open on Friday.

Whitehaven share price halted amid acquisition of BHP's coal mines

BHP first announced that it was looking to divest its Daunia and Blackwater mines, together with its joint venture partner Mitsubishi Development Pty, back in February.

This morning the ASX 200 iron ore miner stated, "BHP confirms that Whitehaven Coal has been selected as the preferred bidder in the divestment process."

On 28 September, we examined the potential headwinds and tailwinds for the Whitehaven share price after reports emerged the coal giant had bid US$3.5 billion for the two coking coal mines. (Coking, or metallurgical coal, is used for steel production.)

At the time, Whitehaven was reported to have bid US$3.5 billion for BHP's two mines.

That's some $200 million above a recent UBS estimate of the combined value of the mines. UBS valued Blackwater, which has a 50-year mine life, at US$2.5 billion, while it valued Daunia, which has a 17-year mine life, at US$800 million.

Either way, Whitehaven is well cashed up for potential acquisitions.

As at 30 June, the ASX 200 coal miner had $2.65 billion of net cash on its balance sheet.

Some shareholder doubts

Not everyone is convinced that the acquisition will benefit the Whitehaven share price.

Bell Rock Capital, one of the ASX 200 coal miner's largest shareholders, is calling for a shareholder vote before the deal moves forward.

According to Bell Rock chief investment officer Mike O'Mara (courtesy of The Australian):

It is vital that this transaction, if it is to proceed, is put to a vote of all Whitehaven shareholders, given the company has provided no information prior to entering this deal. We have raised our concerns about the transformative nature of this proposed transaction with the ASX.

"It's a simple proposition," O'Mara added. "The deal must be superior to the value on offer in the company's own share, as per the published capital allocation framework."

Whitehaven share price snapshot

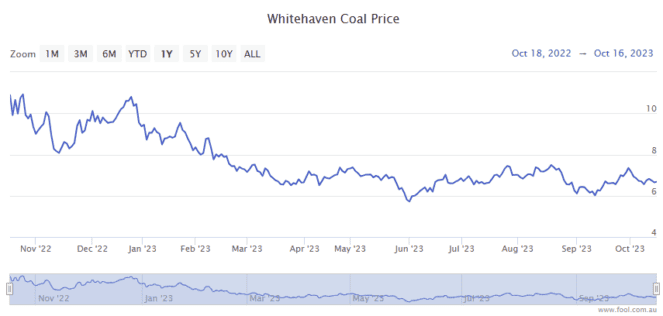

After surging in 2022 amid record-high coal prices, the Whitehaven share price is down 23% in 2023.