Fund manager Wilson Asset Management aims to identify appealing ASX shares that can deliver outperformance where there's a catalyst that could excite the market.

The flagship fund is a listed investment company (LIC) called WAM Capital Ltd (ASX: WAM).

That LIC has delivered an investment portfolio performance (before expenses, fees, taxes and the impact of capital management initiatives) of 14.9% since August 1999. This compares to an average return per annum of 8.1% for the All Ordinaries Accumulation Index (ASX: XAOA).

The WAM team recently highlighted a relatively small ASX tech share that has soared over the past year.

DUG Technology Ltd (ASX: DUG)

WAM described the business as an Australian-based technology company specialising in analytical software development and high-performance computing. DUG Technology itself says that it delivers a "comprehensive geoscience offering" and that it "maximises the value of seismic data".

It has offices in Perth, London, Houston and Kuala Lumpur. DUG said its diverse client base operated in radio-astronomy, biomedicine and meteorology, and the "resource, government and education sectors". The company says it designs, owns and operates a network of some of the largest and greenest supercomputers on Earth.

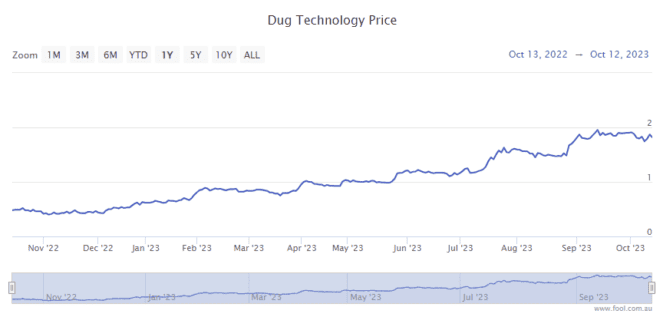

WAM noted that the DUG share price performed strongly in September after the company delivered a record FY23 result.

In addition, DUG Technology secured almost US$50 million in new services projects in FY23 and expanded into new markets.

That FY23 result showed a 51% revenue increase to US$50.9 million and a 153% increase in net profit after tax (NPAT) to US$4.9 million. Operating cash flow jumped to US$13.4 million.

Outlook for the ASX share

The WAM team believes that the company's FY24 outlook is "positive, with several software evaluations underway with potential customers".

DUG's services order book grew by 26% to US$27.9 million at 30 June 2023. It grew further in July after a record-high month of order intake.

New hardware will be installed in the Houston data centre during October 2023 to support new service projects.

The company also said the outlook for its software and HPC businesses looked "strong", with several software evaluations underway with potential customers. The sales teams for all three business lines have been strengthened recently.

The business had net cash of US$5.2 million in June 2023, and it announced with its FY23 result that the cash balance had strengthened since the end of FY23.

It expects to support all its planned initiatives through its balance sheet with financing for new computer and storage assets along with cash generated from operations.

DUG Technology share price snapshot

Over the past year, the DUG Technology share price has risen 275%.