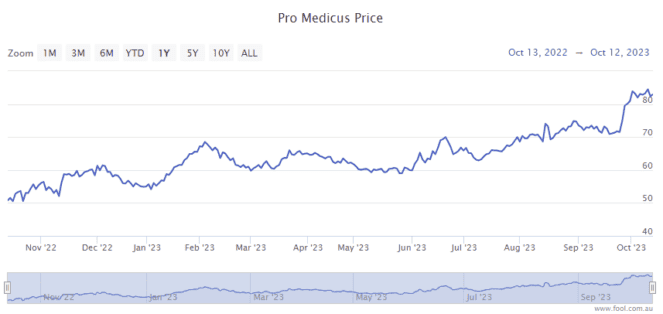

ASX 200 healthcare stock Pro Medicus Limited (ASX: PME) has screamed up the charts in 2023 with a share price gain of 53% to date. And Goldman Sachs thinks it has more room to run.

Pro Medicus shares reached a new all-time high of $84.96 on Friday.

They closed at $83.49, down 0.04% for the day.

In its September Investment Update released yesterday, fund manager Wilson Asset Management said the ASX 200 healthcare technology stock was among its best performers in two funds in September.

Pro Medicus contributed positively to the WAM Capital Limited (ASX: WAM) fund and the WAM Research Limited (ASX: WAX) fund over the course of the month, with its share price rising 13.73%.

Here's what the fundie had to say about Pro Medicus.

'Growing global presence'

Wilson Asset Management detailed some big news announced by Pro Medicus in September.

During the month, the company announced its wholly-owned US subsidiary Visage Imaging had signed a $140 million 10-year contract with Baylor Scott & White Health (BSWH), the largest not-for-profit healthcare system in Texas and one of the largest in the US.

This is the eighth contract Pro Medicus has signed this year and the largest it has signed since it was founded in 1983. Once implemented, the new systems will be used by nearly 500 radiologists at BSWH.

The fundie said it had a positive outlook for Pro Medicus in FY24 — and it's not the only one. As we've reported, Pro Medicus is on Macquarie's most upgraded ASX stocks following reporting season.

Wilson Asset Management said the BSWH deal highlighted the company's "growing presence in the global healthcare technology sector".

Goldman Sachs positive on ASX 200 healthcare stock

Goldman Sachs considers Pro Medicus one of two explosive growth stocks to buy today.

The top broker has a buy rating on Pro Medicus with an $88 share price target.

In a recent note, Goldman said:

Our new estimates imply a +26% EBITDA CAGR (FY23-26E), a 'multiple to growth' ratio of 2.4x, which we view as undemanding vs. ASX Healthcare on 1.8x.

We view PME as the clear incumbent technology leader in a growth market with low-risk market share upside from c.10% today, and the optionality to broaden/deepen into a platform solution for adjacent/complementary offerings.