The Commonwealth Bank of Australia (ASX: CBA) share price is having a top day today. At present, CBA shares have risen by 1.02% up to $101.67 each. That's a lot better than what the broader S&P/ASX 200 Index (ASX: XJO) is doing.

The ASX 200 is currently up as well but by just 0.11%. So CBA is a real market beater today thus far. But that wasn't the case yesterday. Wednesday's trading saw CBA shares lose 0.06% of their value on a day that had the ASX 200 shoot up 0.7%.

This weakness could well have come down to some comments that this ASX 200 bank share's own CEO Matt Comyn made in the bank's annual general meeting address yesterday.

CEO Matt Comyn warns of "lower-growth environment"

Comyn spent most of the address extolling the great year CBA has had, as one would expect. But it;s his comments about the bank's immediate future that are worth a second look today. Here's some of what Comyn said:

With tighter and rapidly changing financial conditions we have taken a prudent approach to managing

risks, including credit, interest rate, funding and liquidity risks. We have also continued to strengthen our balance sheet and we remain well placed heading into a lower growth environment…Looking ahead, the fundamentals of the Australian economy remain strong. At the same time, we recognise that the impacts of higher inflation and higher rates are being felt unevenly across customers and the economy. We expect pressure on households to ease as inflation continues to moderate. The economy remains fundamentally sound and we remain optimistic about the outlook.

We are well provisioned for the changing financial conditions and our strong balance sheet provides flexibility to navigate the current environment and support our customers while delivering sustainable returns.

Does that sound like a person who is trying to discuss a negative issue in a positive light? "Lower growth environment"… "rapidly changing financial conditions"… No wonder investors got a bit squeamish yesterday.

Today, all of that seems forgotten as CBA shares surge. But Comyn's comments are certainly something that all CBA investors and, by extension, ASX investors, should keep in mind as we continue to invest in 2023 and into 2024.

CBA share price snapshot

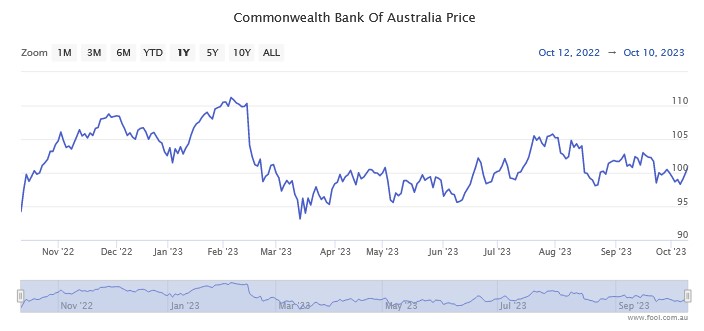

The CBA share price has been treading water for a while now. The ASX 200 banking giant remains in the green in 2023 so far, if only just, with a year-to-date gain of 0.53%. That stretches to a gain of 5.5% over the past 12 months.

However, CBA also remains down by nearly 9% from its all-time high of $111.43 a share that we saw back in February. Check this all out for yourself below:

At the current CBA share price, this ASX 200 bank share has a market capitalisation of $170.2 billion, with a dividend yield of 4.43%.