Wondering if the ASX share market is going to spook investors this month with a nasty bag of investment tricks? Or are we finally in for some timely treats?

Fear not. Our Foolish contributors have compiled a list of the top ASX shares they reckon will lift your spirits in October. Here is what the team came up with:

6 best ASX shares for October 2023 (smallest to largest)

- Vanguard US Total Market Shares Index ETF (ASX: VTS), $3.46 billion

- Premier Investments Limited (ASX: PMV), $3.98 billion

- Flight Centre Travel Group Ltd (ASX: FLT), $4.25 billion

- APA Group (ASX: APA), $10.65 billion

- ResMed Inc (ASX: RMD), $11.35 billion

- Sonic Healthcare Ltd (ASX: SHL) $14.13 billion

(Market capitalisations as of market close 29 September 2023).

Why our Foolish writers love these ASX stocks

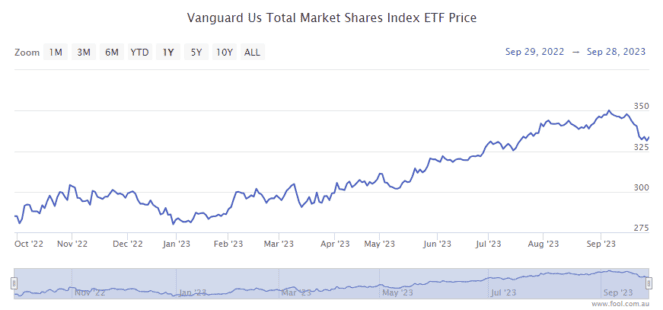

Vanguard US Total Market Shares Index ETF

What it does: This $3.46 billion exchange-traded fund (ETF) is designed to mirror the performance of the entire US stock market, encompassing about 3,800 companies.

By Bronwyn Allen: This ETF provides Australian investors with an easy way to invest in the US stock market.

With a tiny management fee of 0.03%, the Vanguard US Total Market Shares Index ETF provides exposure to all the giant US companies that are global household names, like Apple and Microsoft, while also incorporating all the small-caps and micro-caps. So, we're talking mega diversification, with a 30% tech stock allocation.

So far in 2023, the VTS ETF is up 17%, while the ASX 200 is up 1.4%. Over the past five years, the VTS ETF has risen 57%, while the ASX 200 has lifted 14%.

Motley Fool contributor Bronwyn Allen owns units of the Vanguard US Total Market Shares Index ETF.

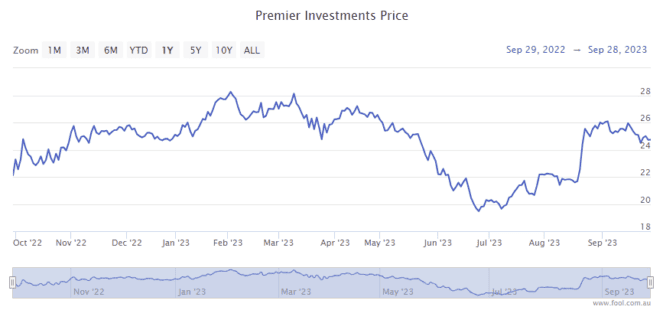

Premier Investments Limited

What it does: Premier Investments is something of an ASX retail conglomerate. Solomon Lew's company owns some of Australia's leading retail brands, including Peter Alexander, Smiggle and Just Jeans.

By Sebastian Bowen: Premier Investments is a stock I've been watching for a while. And I think that the company's recently released full-year earnings for the 2023 financial year make it well worth a look this October.

Not only did Premier reveal lifts in revenues, earnings and adjusted profits, but the company also announced a record final and full-year dividend for FY23. This will push up Premier's fully-franked dividend yield over 5% at current pricing.

Given Solly Lew's track record, as well as the strong brands that this company houses, this retailing powerhouse looks compelling to me right now.

Motley Fool contributor Sebastian Bowen does not own shares of Premier Investments Limited.

Flight Centre Travel Group Ltd

What it does: The ASX 200 travel share counts among the world's largest travel agency groups. Flight Centre operates in more than 23 countries, with a corporate travel management network that spans more than 90 countries.

By Bernd Struben: At $19.38, the Flight Centre share price has already gained 35% in 2023, but I believe there's more outperformance to come. Shares are still down some 50% from pre-COVID levels. While the stock might not retake those highs soon, I believe it could easily gain another 35% amid an ongoing uptick in travel demand.

E&P Capital is also bullish on Flight Centre. The broker has a $27.68 target for its shares, representing a potential upside of 43%. "We believe the combination of positive momentum and efficiency gains will continue to drive strong profit growth over the next two years," E&P stated.

In a promising sign, management declared the first Flight Centre dividend since 2019 when it released the company's FY23 results.

Motley Fool contributor Bernd Struben does not own shares of Flight Centre Travel Group Ltd.

APA Group

What it does: APA owns a large network of natural gas pipelines around Australia, transporting half of the country's usage. It also owns or has stakes in gas processing facilities, gas storage facilities, gas energy generation, renewable energy generation and electricity transmission assets.

By Tristan Harrison: The 21% decline in the APA share price this year is appealing, in my opinion. Its gas assets continue to generate solid cash flow, enabling a growing distribution that has increased each year since 2004. It continues to expand its pipeline network, which bodes well for earnings growth.

Revenue is linked to inflation, so its top line is benefiting from the elevated inflation environment.

I like the move by the business to increase its exposure to renewable energy with a large acquisition called Alinta Energy Pilbara. Investing in renewables and transmission is future-proofing the business, in my view. The plan to investigate transporting hydrogen in its pipelines seems like a smart move and could lengthen the useful lifespan of the pipeline network.

As a bonus, the business expects to grow its distribution in FY24 to 56 cents per security, which is a distribution yield of 6.7%

Motley Fool contributor Tristan Harrison does not own shares of APA Group.

ResMed Inc

What it does: ResMed is a medical device company. It primarily provides cloud-connectable medical devices for the treatment of obstructive sleep apnea (OSA), chronic obstructive pulmonary disease, and other respiratory conditions.

By James Mickleboro: The emergence of obesity drugs this year has caused concerns that demand for ResMed's products could be negatively impacted. That's because a significant portion of sleep apnea sufferers are classed as overweight.

However, while the company's total addressable market will almost certainly reduce because of these drugs, that doesn't mean ResMed cannot continue to grow materially over the long term. Goldman Sachs, for example, estimates that the company has a total addressable OSA patient population of 74 million currently, increasing to 93 million by 2030 despite the growing popularity of obesity drugs.

In light of this, I believe the recent pullback in the ResMed share price has created a compelling opportunity for long-term focused investors.

Motley Fool contributor James Mickleboro owns shares of ResMed Inc.

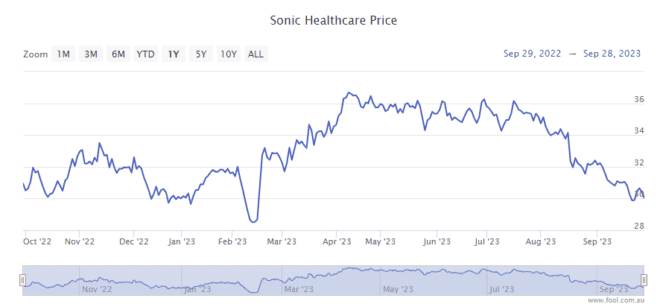

Sonic Healthcare Ltd

What it does: Established in seven countries, Sonic Healthcare has a global presence in the pathology industry. The company is the largest medical laboratory and pathology provider in Australia, the United Kingdom, Germany, and Switzerland. Those in Australia will know Sonic by its Sullivan Nicolaides moniker.

By Mitchell Lawler: Let me paint the scene… Australian inflation remains far above the target band at 5.2%, oil is at 52-week highs, United States bond yields are at pre-GFC levels, and unions are securing major wage deals.

I'm not a pessimist, but it's times like these when it is comforting to hold good companies. I believe a business like Sonic Healthcare will continue to hum along steadily, irrespective of the prevailing economy. People generally won't postpone a blood test or have an X-ray because:

1. It's often covered under Medicare; and

2. Health is a necessity, not a discretionary.

Sonic's dominant market position appears undervalued, in my opinion, at a price-to-earnings (P/E) ratio of 20 times.

Motley Fool contributor Mitchell Lawler owns shares of Sonic Healthcare Ltd.