Any Australian planning an overseas holiday right now would know that the local dollar is depressed globally.

The Australian dollar is currently hovering around 64 US cents, which is as low as it has been since the global financial crisis, bar one short dip during the COVID-19 panic in 2020.

Ouch.

The trouble is that the rest of the world sees the Australian dollar as a proxy for the Chinese economy, because of our reliance on the middle kingdom as our biggest trading partner.

And the Chinese economy is coughing and spluttering at the moment, so the Aussie currency is not about to lift significantly anytime soon.

So what implications does a low Australian currency have on choosing stocks for your portfolio?

Export good, import bad

In the general economy, a low local currency means importers lose while exporters win.

That's because importers suffer from higher supply costs from overseas, while exporters receive more Australian dollars for their products and services sold in foreign currencies.

And this corollary also applies to S&P/ASX 200 Index (ASX: XJO) companies too.

So which specific ASX 200 stocks are massive export businesses?

Healthcare is one space that would be wise to look at.

In this sector, it's typical for Australian companies to develop products and services and then sell them globally, because Australia is a fairly small market while healthcare solutions have demand everywhere.

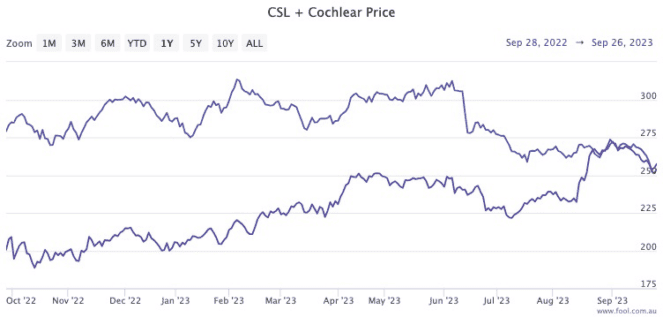

Two great examples are CSL Limited (ASX: CSL) and Cochlear Limited (ASX: COH).

Both sell solutions that are in demand all over the world, so earn much of their revenue in US dollars or Euros.

That revenue then translates to more Australian dollars when repatriated.

Selling Aussie rocks to the world

The other sector that obviously has a major exporting element is mining.

Companies that dig the stuff out of ground in Australia incur expenses in the local currency, then ship the commodity around the world to earn mostly US dollars.

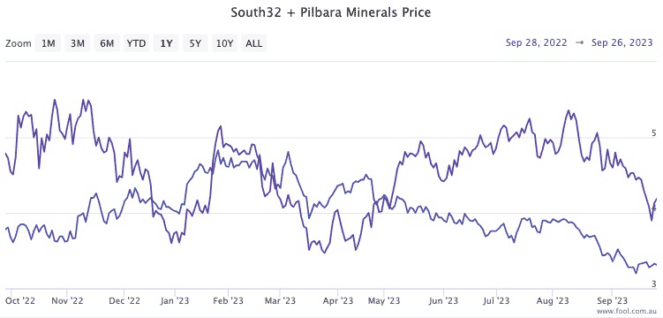

That's why ASX 200 businesses like lithium miner Pilbara Minerals Ltd (ASX: PLS) and multi-mineral producer South32 Ltd (ASX: S32) would be cheering right now.

When combined with the current pessimism about the economy, more than one expert reckons now could be an ideal point of the cycle to buy up resources stocks.

According to CMC Markets, South32 has eight out of 16 analysts rating it as a buy, while Pilbara is backed by eight out of 18.

Something else to think about

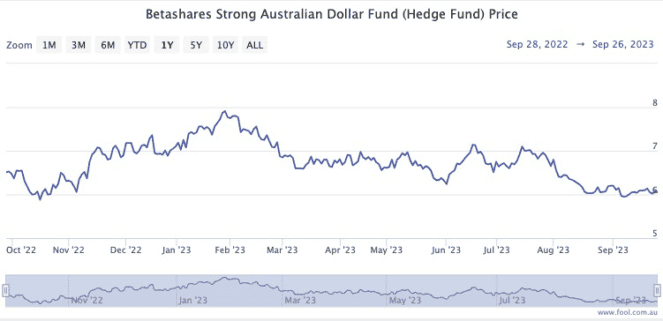

A bonus stock pick for the low Australian dollar could be the exchange-traded fund BetaShares Strong Australian Dollar Fund (ASX: AUDS).

Shaw and Partners portfolio manager James Gerrish explained its functionality last month: "Its goal is to track the performance of AUD v USD."

"It provides geared exposure to AUD of around 2.5x. i.e. A 1% rally by the Australian dollar against the US will generate a 2.5% return and, of course, vice versa."

So if you think the Australian dollar is near the bottom, the value of these shares could rise in the coming months and years.