ANZ Group Holdings Ltd (ASX: ANZ) has been punished with a $15 million fine for misleading customers.

The penalty came after the big bank admitted to the Federal Court that it misled credit card holders about the amount of funds that were available.

There were two ways that ANZ had acted illegally:

- The bank had not cleared deposits into the credit card accounts, meaning the 'available funds' figure was incorrectly larger than what was actually available without incurring fees or interest

- Falsely communicating that customers could get a cash advance from the 'available funds' pool without incurring fees or interest

Australian Securities and Investments Commission (ASIC) deputy chair Sarah Court said customers had a right to "clear and accurate information about available funds in their accounts and what fees and charges may be applied".

"Many ANZ customers relied on the account information displayed by the bank and were charged fees that were inconsistent with that information."

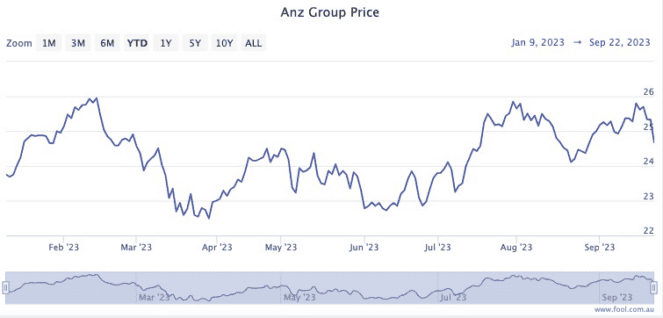

ANZ shares were up 0.04% shortly before midday. They're trading about 8.6% higher since the start of the year.

Not fixing the problem 'efficiently, honestly and fairly'

The Federal Court also criticised the company for not acting "efficiently, honestly and fairly" in dealing with the problem promptly.

"It should not have taken ANZ several years to address this issue," said deputy chair Court.

"These are errors that we expect a bank to be aware of and fix in a timely manner."

ANZ has paid remediation in excess of $8.3 million to more than 186,000 accounts that were charged fees or interest on cash advances from 2016 to 2018.

"In some cases, single customers were charged thousands of dollars in fees while the average remediation paid was around $45 per affected account," stated ASIC.

In addition to the $15 million fine, the bank is now expected to repay customers who were slugged fees and interest between 2018 and 2021.

ANZ did not make an announcement to the ASX in response to the court ruling.