New Hope Corporation Ltd (ASX: NHC) shares are 1.13% higher at $6.27 apiece in early trading on Tuesday.

Since the ASX 200 coal miner delivered its full-year FY23 results last week, four directors have ploughed a collective $720,000 of their own money into the stock.

Does this mean you should buy New Hope shares at today's price?

Let's investigate.

Who's buying New Hope shares?

The buying spree among directors began the day after New Hope's full-year results were released.

First cab off the rank was non-executive director Ian Williams, who purchased 10,000 New Hope shares on-market, at $6.16 apiece, for a total of $61,600 on 20 September.

New Hope chair Robert Millner AO and non-executive director Thomas Millner declared an additional indirect interest of 100,000 New Hope shares on 22 September.

They bought the shares in two separate parcels of 50,000 on-market.

The Millners purchased their first parcel at $6.0554 apiece for $302,770. They bought the second parcel at $5.9801 apiece for $299,005.

Non-executive director Steven Boulton also made a move on 22 September, snapping up 10,000 New Hope shares at $5.95 apiece on-market for $59,500.

Why are they buying?

'Tis the season, as they say.

It's common to see directors buying or selling shares themselves post-earnings season.

This is because ASX listing rules specifically suggest that companies might like to allow trading windows for insider transactions in the period immediately after periodic reports are released.

That way, all the latest critical information is on the table for every investor to see, so there is less risk of any appearance of insider trading.

For the 12 months ended 31 July, New Hope reported record gross revenue of $2,648.8 million. That was an increase of 6% on FY22. Net profit after tax (NPAT) also rose by 10.6% to $1,087.4 million.

New Hope shares will pay a fully franked final dividend of 21 cents per share and a special dividend of 9 cents per share on 7 November.

The ASX 200 coal stock doesn't go ex-dividend til 23 October, so the directors will pick up these monster dividends as well. Bonus.

Wait for a better price, say brokers

While it's encouraging for ordinary investors to see directors buying shares in their own companies, my colleague James points out that several brokers are saying we should wait for a better price.

While these four directors are obviously happy enough to buy at today's price, they may also be buying now because they only have a narrow trading window available to them.

Three major brokers reckon we should wait for a better entry point.

Following the company's results, Citi and Macquarie both put the equivalent of sell ratings on New Hope shares. They have 12-month price targets of $4.20 and $5.50, respectively.

Goldman Sachs has a sell rating and price target of $3.30.

Citi commented:

We believe the recent thermal coal price rally on LNG strikes is overdone and thermal demand should weaken into shoulder season.

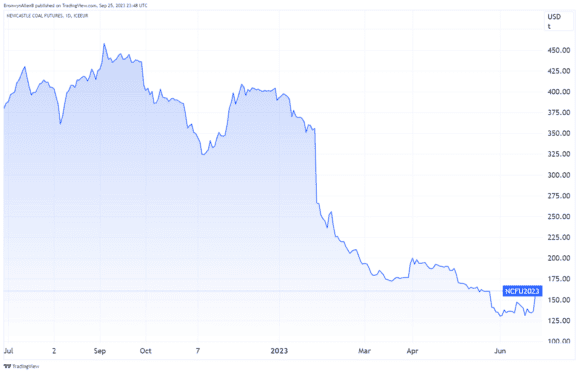

New Hope attributed part of its $1.1 billion profit to record high coal prices in the first half of FY23.

As shown below, coal prices have fallen substantially since the start of FY23.

Commodity prices typically have a direct bearing on the share prices of ASX coal mining stocks.