The Lake Resources (ASX: LKE) share price is off to the races today, up 15% in early trading.

Shares in the lithium stock closed yesterday trading for 16.5 cents apiece and shot to 19 cents each shortly after market open. At the time of writing, the Lake Resources share price is 18 cents, up 9.1%.

For some context, the All Ordinaries Index (ASX: XAO) is down 0.41% at this same time.

Here's what ASX investors are mulling over.

What did the ASX lithium miner report?

The Lake Resources share price is rocketing after the ASX lithium miner reported on the successful completion of the Saltworks Technologies lithium carbonate test program.

The test program produced battery-grade lithium carbonate from Lilac DLE lithium chloride eluate.

The ASX lithium miner delivered 120,000 litres of concentrated lithium chloride eluate to Saltworks Technologies, located in Canada. That eluate was produced from Lake Resources' Kachi Lilac DLE Demonstration plant in Argentina.

Commenting on the successful test sending Lake Resources share price soaring today, CEO David Dickson said it gave the company "great confidence in our process".

"Most DLE lithium carbonate announcements are based on a few kilograms of carbonate produced on a lab bench scale unit," Dickson said. "We've produced more lithium carbonate than most DLE projects under development."

With the extraction technology proven to work, he said the company will now concentrate on designing "well-structured project schedules for a facility with a target design life of 25 years at Kachi".

According to the release, Saltworks demonstrated the Kachi commercial flowsheet unit operations in the processing of 120,000 litres of eluate solution:

- Reverse Osmosis

- Impurity removal (Ca, Mg)

- Evaporation

- Ion Exchange (Ca, Mg, B)

- Lithium Carbonate precipitation

- Centrifuge and Washing

The DLE Demo Plant continues to operate and is expected to produce more than 200,000 litres of eluate and process around four million litres of Kachi brine from multiple wells before shutting down in October.

Also likely offering some tailwinds to the Lake Resources share price today, on the drilling and exploration front, Dickson noted, "We have drilled deeper for better grades and improved our drilling performance by 40% this year."

He added that grades from recent extraction tests were 20% higher than exploration samples.

Lake Resources reported it's still on track to complete its Definitive Feasibility Study (DFS) in December.

Lake Resources share price snapshot

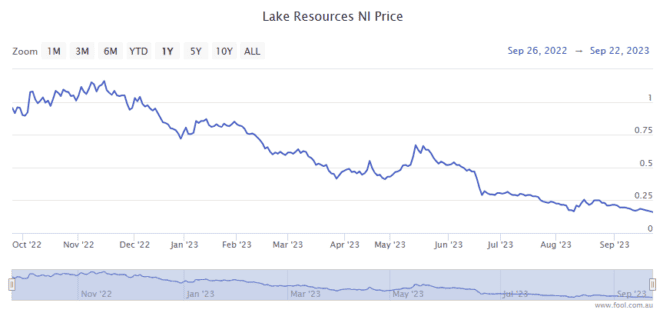

With today's intraday gains factored in, the Lake Resources share price remains down 79% over the past 12 months.