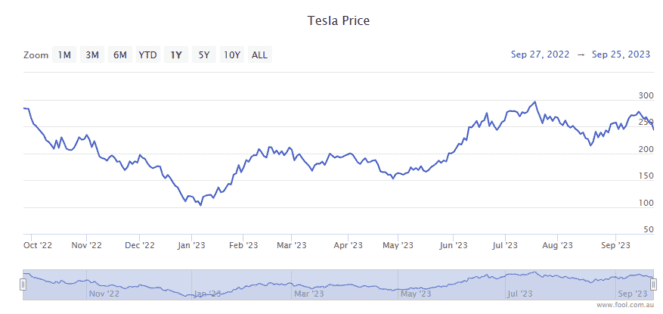

Tesla Inc (NASDAQ: TSLA) shares closed up 0.9% overnight, ending the day trading for US$246.99 apiece.

That sees Elon Musk's EV and tech company up an impressive 128% so far in 2023, far outpacing the 28% year to date gains posted by the Nasdaq Composite Index (NASDAQ: .IXIC).

Still, Tesla shares have some ways to go before recouping their all-time November 2021 highs of just over US$409.

And the stock would need to soar 467% from current levels to reach US$1,400 per share.

Is that really possible in just four years?

Can Tesla shares continue to charge higher?

A 467% leap in Tesla shares may sound pie in the sky. But then, Musk's company has soared 1,440% over the past four years.

So, a four-year run to US$1,400 per share is certainly possible.

Shorter-term, the company faces some headwinds from increasing competition in the EV markets, particularly from China. Rising competition saw Tesla significantly cut the prices of its vehicles this year. This led to increased sales but a decline in the company's Q2 operating margin, which dropped from 14.6% to 9.6%.

That's likely to impact profits and could drag on Tesla shares in the near term.

However, over the medium and longer term, the company is investing heavily in novel manufacturing processes and new technologies, aiming to cut the price of its next-generation EVs by some 50%. If those tech investments pay off, that would see those operating margins ramp back up.

And there's some other potentially game-changing tech Musk has been pouring money into.

Wait, who's driving this car?

Among the leading tech achievements that could spur Tesla shares higher is its supercomputing Dojo technology. Musk believes this tech will enable Tesla vehicles to drive without any human intervention. And he foresees it happening soon.

It's this autonomous capability, which opens the door to Tesla robotaxis, that has Ark Invest CEO Cathie Wood forecasting Tesla shares will indeed reach at least US$1,400 in four years.

The idea behind robotaxis is that Tesla owners would send their cars out to work as autonomous taxis. And Tesla would get a share of any revenue earned.

Wood, for one, is a big believer in the revenue-boosting potential of robotaxis.

In April Ark Invest forecast that Musk's company could reap annual net revenue of some US$200 billion by 2027 from robotaxis.

Last week, Wood told CNBC she expects Tesla will likely be launching its autonomous ride-hailing service next year. And it's this development that accounts for two-thirds of Ark Invest's projected value of Tesla shares. The company's EV production represents the other third.

While Tesla will face competition in the robotaxi space, Wood pointed out that Musk's car company has a big head start. According to Wood, it has more data to work with, mostly from its vehicle sensors and cameras, than all the other self-driving carmakers combined.

"Tesla is in the pole position here in the United States," she said.