Have you ever wondered which ASX All Ords share holds the trophy for the highest price-to-earnings (P/E) ratio? More importantly, does its supreme premium make it an investors' nightmare by default?

In the world of investing, P/E ratios are often used as the go-to yardstick for determining value. Investors will compare a company's earnings multiple to peers, its industry average, or an index. If it's below those, then it's apparently cheap — and if it's above, it's expensive.

It is a reductive analysis, yet widely used.

So, is Chrysos Corporation Ltd (ASX: C79) overvalued if its P/E is 1,364 times?

Why this ASX All Ords share appears 'expensive'

Chrysos Corporation joined the All Ords index in the March 2023 quarterly rebalance. The company provides an alternative assay solution for determining the content of gold, silver, or copper from ore samples.

The method of putting samples under an X-ray is Chrysos' improvement upon the ancient fire assay procedure. This patented technology is bundled into an assaying machine called the PhotonAssay, deployed and leased to miners and testing laboratories in Australia, North America, and Africa.

Obviously, the elephant in the room is the 1,364 times earnings multiple this company trades on. As shown in the table below, this is almost two orders of magnitude greater than peers and the broader index.

| Comparison | P/E Ratio |

| Chrysos Corporation | 1,364 |

| Australian commercial services industry | 17.4 |

| S&P/ASX All Ordinaries Index (ASX: XAO) | 19.3 |

Such a P/E ratio would send a traditional value investor running for the hills. However, there's more here than meets the eye.

The earnings multiple is distorted due to Chrysos achieving net profits after tax (NPAT) marginally above breakeven at $443,000.

Crucially, this isn't a company that has reported flat revenue for five years and is regularly posting sub-$1 million earnings. In FY23, Chrysos grew its top-line figure by 89% compared to the prior year. Likewise, management expects to dial this up another 98% in FY24 at its revenue guidance midpoint.

Could it still be worth buying?

The extent to which this ASX All Ords share constitutes a buy depends on a personal deduction of intrinsic value. It truly comes down to what seems like a likely rate of growth for this company in the future.

As legendary investor Terry Smith once shared, "The level of valuation which may represent good value at which to buy shares in a high-quality company may surprise you."

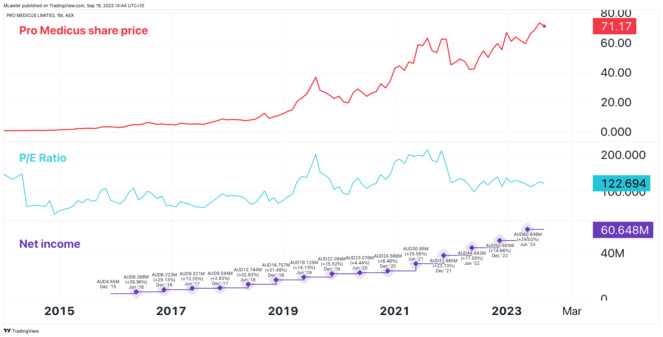

One such example I own is Pro Medicus Limited (ASX: PME). Rarely has the company traded on a P/E less than 60 in the last seven years. Yet, you could have purchased shares in the medical imagining software company at nearly any time in its history and made money.

In FY16, Pro Medicus made $6.4 million in earnings. Fast forward seven years, and it's making nearly ten times as much, as shown above.

The rate of adoption/utilisation of Chrysos' PhotonAssay will be an essential metric to track. If it can become a widespread replacement for fire assays and expand into other commodities, it might shake off the perception of an 'expensive' ASX All Ords share.

In many ways, the Chrysos story looks similar to Pro Medicus… but that's an article for another day.