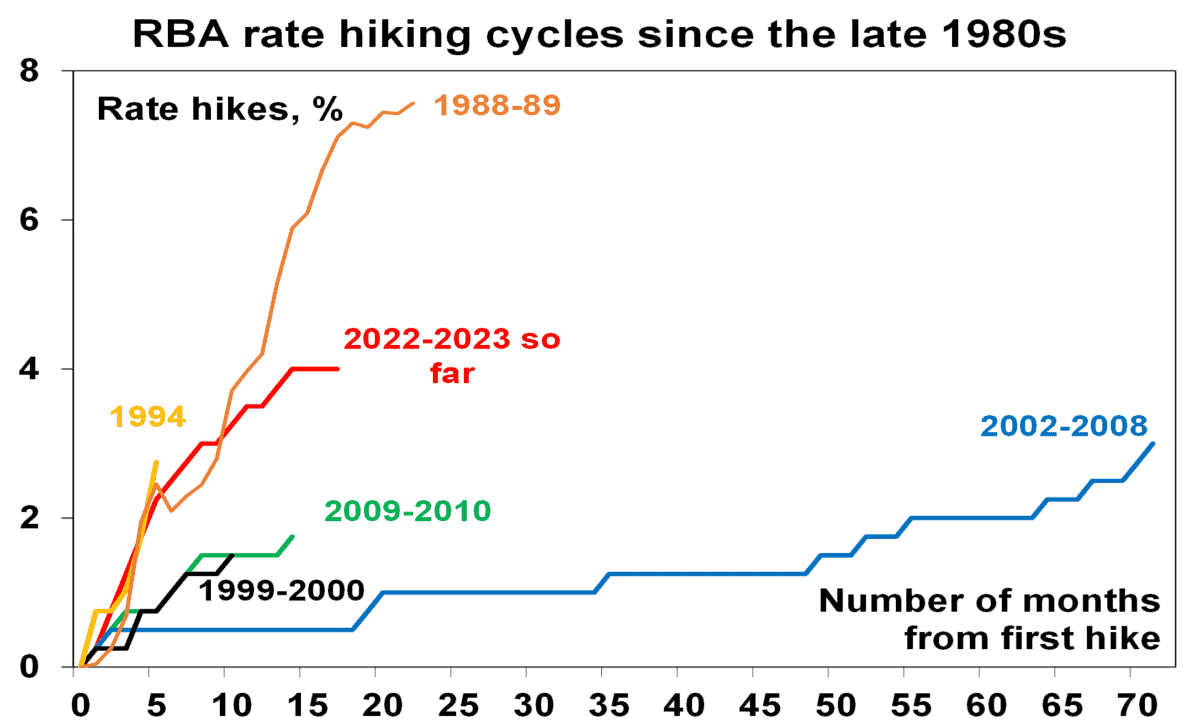

Australian investors, consumers and businesses have had to endure a rough time over the past 16 months, as interest rates have increased more than 400 basis points.

The 12 rate hikes over 14 Reserve Bank board meetings have been all in the name of fighting inflation.

The last time Australians had to cop such treatment was during the late 1980s rate hike cycle, although AMP Ltd (ASX: AMP) chief economist Dr Shane Oliver argues the impact is worse now.

"While the 1988-89 rate hiking cycle was nearly double that seen since May last year, back then household debt to income ratios were about one third of current levels.," Oliver said on the AMP blog.

So when will the pain end?

For the love of God, that's enough interest rate rises

Oliver admits his team never thought the central bank would go this far.

"But our view remains that the RBA has done more than enough to bring inflation back to target and so we are likely at the peak."

The tricky aspect of managing the economy through interest rate manipulation is that the impact takes many months to cascade out.

And that delay is even worse this time.

"It takes a while for the hikes to be passed through to borrowers and for them to adjust their spending and for this to impact companies and jobs.

"This time around, the lag has likely been lengthened by savings buffers built up in the pandemic, the reopening boost, more-than-normal home borrowers locking in at 2% or so fixed mortgage rates in the pandemic, and the highly competitive mortgage market, which has meant that actual mortgage rates paid on outstanding mortgages have gone up by less than the cash rate."

But those saving graces are now disappearing.

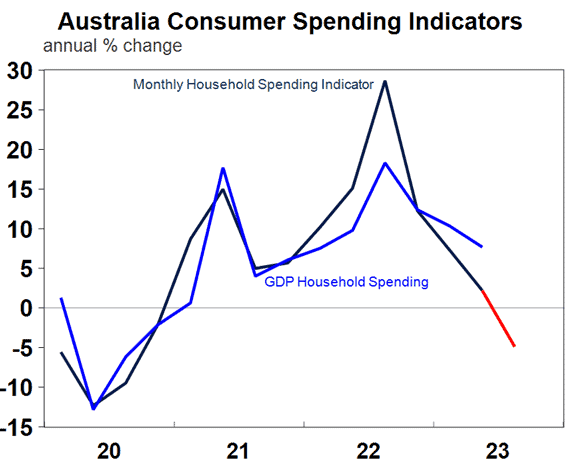

The cold hard reality is that a homeowner with a $600,000 mortgage is now paying about $1,300 more each month than what they were May last year.

"That's an extra $15,700 a year… This is a very big hit to household spending power," said Oliver.

"Real retail sales have fallen for three quarters in a row and are very weak on a per capita basis, i.e. adjusting for population growth."

GDP growth and the labour market have both cooled, according to the latest numbers.

Looking forward to rate cuts

Oliver feels that if the RBA raises rates any further, calamity could result.

"Continuing to raise interest rates will only add to the already very high risk — at around 50% — of recession.

"At the very least, the economy is likely to have slowed substantially by late this year, with unemployment starting to rise faster than the RBA is allowing for. This will likely see inflation fall next year faster than the RBA expects."

Therefore, his team is forecasting that interest rates are now at a maximum, and consumers, businesses and ASX investors can all look forward to a cut.

"Our base case is that the cash rate has peaked ahead of rate cuts starting in the March quarter next year, which should help growth then stabilise and improve later next year.

"The RBA is expected to leave interest rates on hold for the rest of this year ahead of rate cuts next year. We are allowing for four rate cuts through 2024 as the economy and inflation slow further."

While the goal of outgoing RBA governor Philip Lowe was to cool the economy, Oliver reckons his replacement would have a substantially different mission.

"Soon-to-be Governor [Michele] Bullock should get an easier run than Governor Lowe. Her main challenge may be trying to turn the economy back up."