With reporting season done and dusted, spring is in the air.

But it's no time to relax for ASX investors, as there is plenty of action to monitor this week.

Here are the three biggest events to keep an eye on, according to eToro market analyst Farhan Badami:

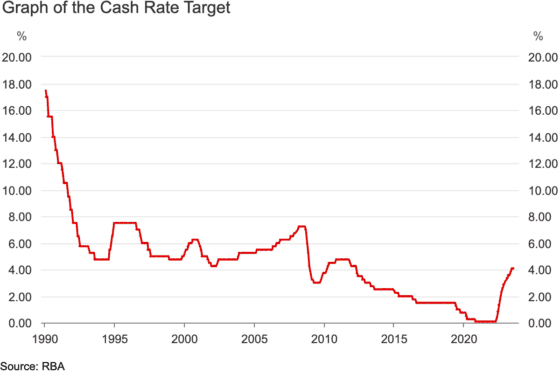

1. RBA rate decision

It's a no-brainer which is the most critical development to watch this week.

Tuesday's Reserve Bank board meeting, which will be governor Philip Lowe's swan song, is expected to keep interest rates on hold.

According to Badami, markets have priced in an 86% chance that the cash rate would not change in September — and even a 14% chance RBA would cut rates.

"Last week, the ASX closed with gains on four consecutive days," he said.

"We are not out of the woods yet, but RBA's pursuit of a soft landing still appears to be on track."

Long-suffering mortgage holders are hoping for an interest rate cut before Christmas, but the bank sector is not expecting such relief this year.

"With Michele Bullock set to take the helm this month, economists are tipping her first crack at easing rates may be a while away — in the third quarter of 2024."

2. Australia's GDP growth rate

A massive gauge of Australia's economic health will be revealed on Wednesday when the GDP figures are released.

The stock market has its fingers crossed for better numbers than June's 0.2% growth, according to Badami, which was the weakest expansion since COVID-19 lockdowns in September 2021.

"The bottom line is that while prices are easing in some sectors, consumers are still struggling with climbing costs overall and are opting out of discretionary spends, which we saw impact homewares and home entertainment retailers in August's ASX earnings announcements."

Even if there is an improvement, Badami doesn't forecast it will be huge.

"Economists broadly will be expecting more growth than a 0.2% shift in tides, but I think very few will be banking on anything above a 0.6% improvement."

3. China, Australia trade balances

The trade balances for both Australia and its largest trading partner will be announced late in the week.

"Assistant minister for trade Tim Ayres expressed this week that he wants trade ties with China to be normalised on the prerequisite that [Beijing] remove the remaining trade restrictions that were introduced in early 2021, which affected significant exports such as red wine, red meat and timber."

China is struggling to reignite its economy after the brutal COVID-19 lockdowns ended late last year.

"Property and construction industries [are] in a slump, and while Australia is only the nation's sixth largest trading partner, restoring the relationship between both countries could provide a significant net benefit."