Passive income investors may be interested to know that top broker Goldman Sachs is expecting National Australia Bank Ltd (ASX: NAB) shares to pay an annual dividend of $1.66 per share in FY23 and FY24.

Today, NAB shares closed the session at $28.60 a piece, which means a dividend yield of 5.6%.

ASX 200 bank stocks are a traditional favourite choice among investors seeking to maximise their passive income from share investments.

Currently, the big four ASX 200 bank shares are tipped to pay dividend yields of between 4.2% and 6.9%.

On top of these yields is 100% franking, which goes a long way to reducing the tax investors have to pay.

With NAB expected to release its 3Q FY23 update next Tuesday, is it time to buy NAB shares for a passive income boost?

Let's review what the experts have been saying about NAB bank lately.

But first, prospective investors might like to see a comparison of FY24 dividend predictions for the big four banks.

So, let's start there.

NAB shares to pay third highest passive income of the Big 4

Morgans is tipping Westpac Banking Corp (ASX: WBC) shares to pay $1.52 per share in dividends in FY24. That's a 6.87% dividend yield based on today's closing price of $22.14.

Goldman reckons Australia and New Zealand Banking Group Ltd (ASX: ANZ) shares will pay $1.62 per share in dividends in FY24. That's a 6.37% dividend yield based on today's closing price of $25.40.

Commsec estimates suggest Commonwealth Bank of Australia (ASX: CBA) shares will pay $4.35 per share in dividends in FY24. That's a 4.16% dividend yield based on today's final price of $104.47.

What are the brokers saying about NAB shares?

It's worth noting that NAB shares have had a run in recent months.

They've risen 13.95% from their 52-week low of $25.10 in June.

Currently, Goldman has a buy rating on NAB shares and a 12-month share price target of $30.69.

This suggests a potential upside of 7.3% from current levels.

That's not much, but we have to remember that ASX 200 bank shares do not have a strong history of capital growth. They are generally valued by investors as dividend shares.

The exceptions are CBA and Macquarie Group Ltd (ASX: MQG), which are considered the growth shares among the ASX 200 banks.

Goldman likes NAB shares over the other banks because it sees "volume momentum over the next 12 months as favouring commercial volumes over housing volumes, and we believe NAB provides the best exposure to this thematic".

Macquarie is neutral on the ASX 200 banks, but it ranks NAB the best of the bunch.

Macquarie says:

We see limited scope for banks to re-rate from current levels …

In the medium term, while banks appear cheap on an absolute basis and compared to their recent history relative to the broader market, we expect discounted valuations to persist until there is more clarity on the economic outlook.

History of NAB dividends and passive income for investors

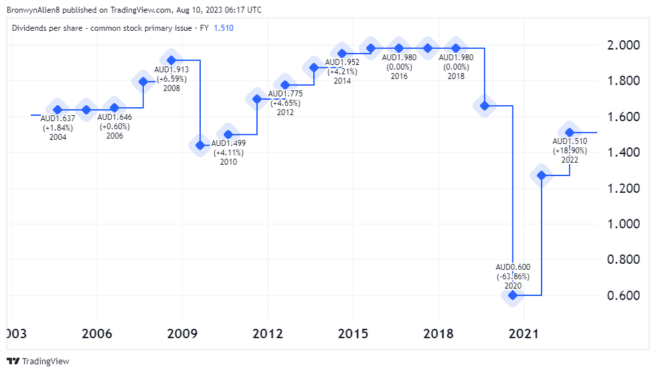

The chart below shows the 20-year history of NAB dividends.

It shows the dividend amount paid and the percentage change compared to the year before.

As you can see, NAB shares have been a reasonably reliable passive income generator for investors.

NAB has a history of increasing or maintaining dividend levels in most years, with a few exceptions.

The most notable, of course, was in 2020, the year the COVID-19 pandemic hit us.

What's the latest news from NAB?

NAB will deliver its third-quarter update next Tuesday.

As my Fool colleague James reports, Goldman has a few specific expectations.

For one, it's expecting NAB to record a net interest margin (NIM) of 1.75% in FY23.

During the first half, NAB's NIM came in at 1.77%.

Goldman is expecting NAB's NIM to fall to 1.67% in FY24 and then 1.62% in FY25.

In terms of earnings, Goldman expects full-year FY23 cash earnings of $7,726 million.

In 1H FY23, NAB reported cash earnings of $4,070 million, up 17% on the prior corresponding period.

If Goldman is on the money, second-half cash earnings will be about $3,656 million.

Australia's biggest bank, CBA, reports on a different timeline to NAB and other ASX 200 bank shares.

CBA just dropped its FY23 full-year results this week.

It reported a NIM of 2.07%. That was up by 17 basis points year-over-year, but there was also a decline in the second half by five basis points.

The full-year report was in line with expectations, and the CBA share price rose by 2.74% on the day.