The Boral Limited (ASX: BLD) share price is shining brightly on Thursday as shareholders unravel the company's FY2023 full-year results.

At the time of writing, shares in the building products and construction materials maker are 6.5% higher, trading at $4.66. In contrast, the S&P/ASX 200 Index (ASX: XJO) is flat compared to yesterday, weighed down by the tech and financial sectors.

Broad strength sends Boral share price soaring

Highlights in the company's earnings report include:

- Revenue up 17% to $3,460.6 million

- Earnings before interest, taxes, depreciation, and amortisation (EBITDA) up 38% to $454.4 million

- Underlying net profit after tax (NPAT) quadrupled to $142.7 million

- Statutory NPAT fell from $960.6 million to $148.1 million

- Operating cash flow increased 65.5% to $358.7 million

- Cash of $658.1 million at 30 June 2023 after reducing debts by $629 million

What else happened in FY23?

The 2023 financial year marked the first complete loop around the track with Vik Bansal in the driver's seat. Tasked with turning around a company struggling with profitability, the former Cleanaway Waste Management CEO focused on volume, price and cost.

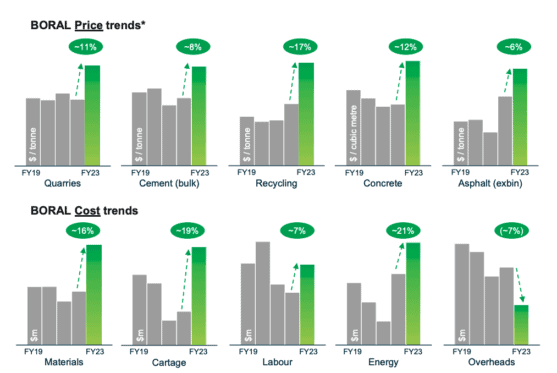

Faced with rising input costs in its raw materials, Boral implemented 'long overdue' price increases across all its products, as shown below. In addition, despite the visible leap in costs, such as materials and cartage, the company improved its EBITDA margin by 1.96% to 13.1% in FY23.

Shareholders and analysts alike have been impressed so far with Bansal's guiding hand. In over a year, the new CEO has reduced the company's debt burden, implemented price rises and cost controls, and increased volume.

As a result, the Boral share price has gone from strength to strength since Bansal's appointment on 8 June 2022, depicted above.

What did Boral management say?

Speaking on the successes achieved in the financial year, CEO Bansal said:

I am pleased to see Boral deliver a set of full-year results that show clear improvement across the entire business, and point to the opportunities that remain ahead. We have seen volume growth across all our products, coupled with a disciplined approach to price, cost, and cash.

Safety of our people is our highest priority, and zero harm remains our goal. Significant work remains to deliver best-in-class performance we strive for, and a 47% improvement in our recorded injury rates equates to 83 fewer people injured compared to the previous year.

Bansal also highlighted the phase of 'simplification and standardisation' that Boral is undergoing, stating, "This standardisation helps in productivity, efficiency, and ownership by the people."

What's next for Boral?

The outlook provided for FY24 further adds to the pleasing result for Boral shareholders today. According to the release, management expects earnings before interest and tax (EBIT) to be between $270 million and $300 million, assuming there are no large changes to demand or prices.

Analysts' estimates were beaten by roughly 5% on this guidance, giving investors further confidence in the turnaround story.

Boral share price snapshot

In 2022, around 52% of the Boral share price was carved off as earnings came under pressure. However, this year is shaping up to be a completely different image, with shares in the materials company already up 63% in 2023.

Boral shares now trade on a price-to-earnings (P/E) ratio of approximately 35 times based on today's published statutory NPAT.