The Allkem Ltd (ASX: AKE) share price is not receiving the positive jolt you might expect amid a drilling update on Thursday.

At the time of writing, shares in the multi-billion-dollar lithium producer have corroded by 0.9% to $14.67. The reaction is roughly in line with the broader S&P/ASX 200 Index (ASX: XJO), slipping to a two-week low following a scathing response to US equities last night.

Let's look beyond the superficial and gather what Allkem's update means.

More lithium at James Bay

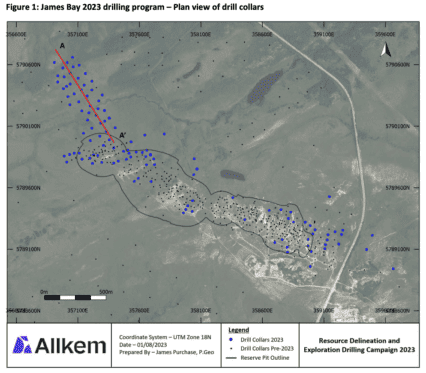

Back in May this year, Allkem revealed the company had found a swarm of spodumene-bearing pegmatite dykes at the James Bay Project, situated in Quebec, Canada. These findings were located northwest of the existing mineralisation — dubbed the 'NW Sector', depicted below.

Those drilling results included intercepts of 125 metres at 1.7% lithium oxide from 68 metres in drill hole JBL-23-048 and 72 metres at 1.89% lithium oxide from 11 metres in drill hole JBL-23-024. The findings helped Allkem shares edge higher on the day.

It's a different story today as the ASX lithium share moves lower amid the latest James Bay drilling update.

Today, Allkem has succeeded in identifying further mineralisation in the NW Sector. According to the release, the company's assay results "continue to demonstrate thick intercepts of lithium mineralisation within spodumene-bearing pegmatites in the NW Sector." The latest findings include:

- 114 metres at 1.73% lithium oxide from 140.5 metres in drill hole JBL-23-050

- 94 metres at 1.87% lithium oxide from 107 metres in drill hole JBL-23-085

Allkem will use these assay results and earlier findings to increase the mineral resource indicated at James Bay. In May, the estimated mineral resource was considered to be 40.3 million tonnes at 1.4% lithium oxide with a 19-year project life.

Commenting on today's update, Allkem managing director and CEO Martin Perez de Solay said:

These outstanding drilling results confirm a material extension of mineralisation at James Bay. Work is now focussed on reviewing the Mineral Resource to include the additional results from the 2023 drilling program and an update is expected by the end of the month.

James Bay is a Tier 1 lithium asset with the potential to grow even further as the boundaries of mineralisation are tested through an additional drilling program commencing later in the year.

What else could be impacting Allkem shares?

There are a couple of possible negative drivers for the Allkem share price on Thursday. The first is the most simplistic.

As it stands, Allkem is to merge with Livent — a large US-based lithium chemicals company — forming a single company currently referred to as New TopCo. That means Allkem shareholders, by proxy, also have a vested interest in Livent.

Shares in Livent fell 2.8% during last night's trading, which could be weighing on Allkem shares.

Additionally, the selected board of directors of the New TopCo were unveiled this morning. Perhaps surprisingly, the current Allkem CEO, Martin Perez de Solay will not form part of the new board. Instead, Perez de Solay will retire as a director upon the closing of Allkem and Livent's merger.

The current Allkem CEO sat at the helm of Orocobre from late 2018 until it merged with Galaxy Resources, forming Allkem. During this time, Perez de Solay oversaw enormous value creation for shareholders.

Investors in the lithium giant might be unsettled by the prospects of new leadership. However, Allkem shares are still up an impressive 32.8% year-to-date.