Investors seeking to boost their passive income might be interested to know that Westpac Banking Corp (ASX: WBC) shares are tipped to pay the highest dividend yield of the 'big four' bank stocks in FY24.

Top broker Morgans is expecting Westpac shares to deliver a $1.52 annual dividend in FY24.

Remember, the dividend yield is calculated as a percentage of the current share price.

Westpac shares closed at $21.98 per share yesterday, so this means a yield of 6.9% for today's buyers.

On top of that is 100% franking.

Does this mean it's time to buy Westpac shares for a passive income boost?

Let's review what the experts have been saying about Westpac shares lately.

But first, let's do a quick comparison of the big four banks and their predicted FY24 dividends.

Westpac to deliver top passive income of the big 4

Our recent comparison showed that Australia and New Zealand Banking Group Ltd (ASX: ANZ) will pay the second-highest dividend yield among the big four banks at 6.4%.

Goldman Sachs predicts the annual ANZ dividend in FY24 will be $1.62 per share.

ANZ shares closed at $25.35 yesterday.

Next is business banking specialist National Australia Bank Ltd (ASX: NAB), with a passive income yield of 5.9%.

This is based on Goldman's expectation of a $1.66 per share dividend in FY24.

The NAB share price closed at $28.11 yesterday.

Lastly, Commonwealth Bank of Australia (ASX: CBA) shares will pay a 4.2% passive income yield according to Commsec estimates.

Commsec tips an annual CBA dividend of $4.35 for FY24.

CBA shares finished trading on Wednesday at $103.46.

What are the brokers saying about Westpac shares?

Morgans says Westpac "has the greatest potential for return on equity (ROE) improvement amongst the major banks if its business transformation initiatives prove successful".

Morgans explains:

The sources of this improvement include improved loan origination and processing capability, cost reductions (including from divestments and cost-out), rapid leverage to higher rates environment, and reduced regulatory credit risk intensity of non-home loan book.

Yield including franking is attractive for income-oriented investors, while the ROE improvement should deliver share price growth.

The broker has an add rating on Westpac shares and a 12-month share price target of $24.22.

Macquarie is neutral on ASX 200 banks in general. It ranks Westpac shares second to NAB for investment.

Macquarie says:

We see limited scope for banks to re-rate from current levels and believe the risk to multiples in the near term remains skewed to the downside, while investors remain concerned with potential credit quality issues stemming from economic slowdown.

In the medium term, while banks appear cheap on an absolute basis and compared to their recent history relative to the broader market, we expect discounted valuations to persist until there is more clarity on the economic outlook.

In June, Goldman Sachs removed Westpac shares from its conviction buy list in favour of ANZ.

Goldman cuts its rating on Westpac shares from buy to hold with a share price target of $23.39.

The broker said it expects rising costs and inflation to erode profits:

… recent feedback on ongoing IT and staff cost pressures, coupled with incremental productivity benefits likely getting harder as WBC gets further into its reset program, sees us now expecting some cost growth in FY24E (previously broadly flat).

WBC's relative skew towards consumer lending leaves it more exposed to the macro environment that we foresee, where we forecast housing lending growth to trough at a c.50-year low of just 1% in Mar-24, versus the 4.5% trough for business lending.

History of Westpac dividends

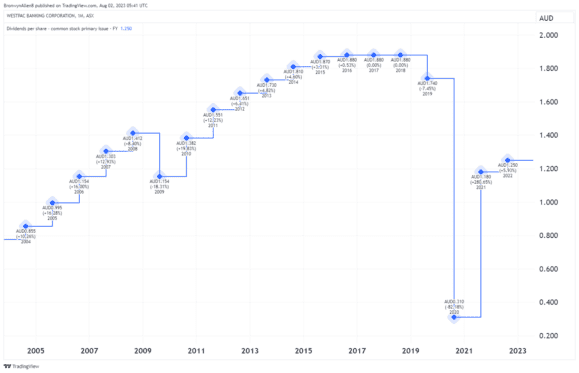

The chart below shows the 20-year history of Westpac dividends.

It shows the dividend amount paid and the percentage change compared to the year before.

As you can see, Westpac shares have proven themselves to be reliable for passive income.

Australia's oldest bank has a history of increasing dividends every year, with a few exceptions.

The most notable, of course, was the year COVID-19 hit us.

What's the latest news from Westpac?

In late July, Westpac announced a restructuring to support the bank's next strategic phase.

Westpac's CEO, Peter King, explained:

Over the past few years we've simplified the bank, including exiting nine businesses. As a result, we no longer need a Specialist Businesses Division.

We are also establishing a stand-alone function to accelerate our Technology simplification and will move Operations to Corporate Services, creating an expanded shared services team.