A fire could be lit under your ASX shares on Tuesday afternoon.

That's the inference from 67% of economists surveyed by comparison site Finder, who think the Reserve Bank of Australia will not raise its cash rate this week.

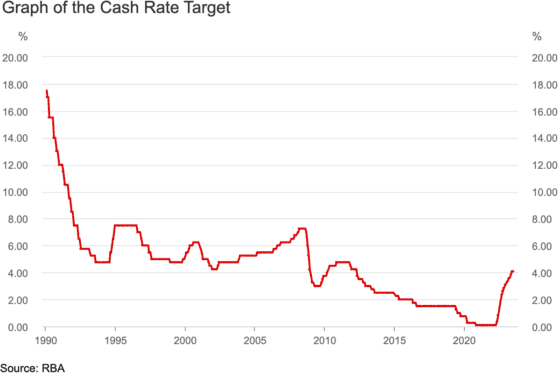

Interest rates have pushed up 12 out of the last 14 months, so an August hold could mean considerable relief for both mortgage holders and stock investors.

Sydney University academic Cameron Murray, who is tipping a hold, reckons the worst is behind us now.

"Inflation has peaked. And globally, inflation is rapidly falling."

On Friday the Australian Bureau of Statistics revealed that national retail turnover plunged 0.8% in June, suggesting economic activity is slowing considerably.

"Retail turnover fell sharply in June due to weaker-than-usual spending on end of financial year sales," said ABS head of retail statistics Ben Dorber.

"This comes as cost-of-living pressures continued to weigh on consumer spending."

Moody's Analytics economist Harry Murphy Cruise cited June inflation figures as the reason for strengthening the chances of no change in interest rates.

"The narrow path to a soft landing remains precarious, but it is less perilous than it was just a handful of months ago," he said.

"Inflation will track lower from here. By the end of the year, we see inflation sitting at 3.9% y/y. It should return to the RBA's 2% to 3% target band by the September quarter of 2024 — almost a year ahead of the RBA's projections."

Is this the end of the rising part of the interest rate cycle?

In the opposing camp, AMP Ltd (ASX: AMP) chief economist Dr Shane Oliver reckons on Tuesday afternoon, the Reserve Bank will impose another rate hike on Australians.

"Our base case is now for just one more rate hike as the RBA likely remains concerned about high and still rising services inflation and upside risks to wages growth," he said.

"However, the RBA has likely already done enough, and inflation is now falling rapidly, so it's a very close call."

According to Finder money expert Richard Whitten, a rise in rates this week will be devastating for already struggling Australian households.

"If the RBA does hike the cash rate in August, it will be death by a thousand cuts for many."

Finance commentator Noel Whittaker forecasts the RBA will provide relief for consumers and businesses on Tuesday, but that's not the end of the story.

"I think the Reserve Bank would be looking for an excuse to put rates on hold given the amount of anecdotal evidence that the interest-rate rises are having some effect on consumer spending," he said.

"However, July has been a big month for price increases, but they are not reflected in last week's CPI figures. But they will be in play at next month's board meeting. So my view is hold this month but increase next month."

A separate Finder survey found that a whopping 40% of home loan holders are struggling with their mortgage repayments in July.

One year ago, that rate was just 26%, and 21% in July 2021.

Monash University professor Mark Crosby predicted things could get ugly in the coming months.

"As more fixed rate loans expire, more homeowners will struggle – this is likely to peak in the second half of 2023."