The Meta Platforms Inc (NASDAQ: META) stock price is soaring after releasing the company's second-quarter results for FY23.

Before the announcement, shares in the Facebook owner moved modestly higher during normal trading hours. However, the stock price is now hovering around US$320.20, up 7.2% in after-hours. If the advertising behemoth can open at this price tonight, it would take its year-to-date gain to 156.7%.

Let's delve into why investors are cheering about Meta's second-quarter results.

Ads are back

Here are the important figures driving the Meta stock price:

- Revenue up 11% year-on-year to US$32.0 billion

- Income from operations grew by 12% to US$9.39 billion

- Operating margin holding flat year-on-year at 29%

- Net income after tax up 16% to US$7.79 billion

- Diluted earnings per share (EPS) jumped 21% to US$2.98

Meta Platforms beat analysts' expectations on revenue and EPS in what appears to have been a broadly strong quarter for the tech company.

The estimates for these two metrics were US$31.12 billion in revenue and US$2.91 per share in earnings. These numbers were exceeded as Meta experienced double-digit revenue growth for the first time since 2021.

Pleasingly, usage across its range of apps — including Facebook, Instagram, WhatsApp, and Threads (Family of Apps) — grew compared to the prior corresponding period. For instance, 'Family daily active people' reached an average of 3.07 billion people during the quarter, increasing 7%.

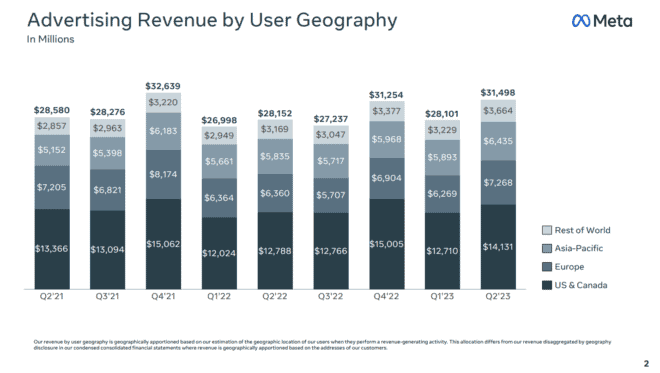

Most notably, advertising impressions flew 34% higher, showing resilience amid a tough economic environment. Although, the average price per ad fell 16% versus its comparable period. Despite this, the company's advertising revenue hit its highest level since the fourth quarter of FY2021, as pictured below.

The income generated by Family of Apps remains to be highly lucrative for Meta and its stock price. From the US$31.72 billion the segment generated, US$13.13 billion translated into operating income. The company threw off US$10.96 billion in free cash flow during the quarter, rising 58.5% from the previous quarter.

Still a worry for Meta stock

While it was mostly a strong quarter for Meta, there was still an elephant in the room… the metaverse endeavour, Reality Labs.

Despite the company's employee numbers reducing by 14% compared to the prior corresponding period, founder Mark Zuckerberg isn't giving up on the costly experiment. The segment chewed through US$3.74 billion over the three-month period.

Worryingly, losses from the unproven segment are expected to 'increase meaningfully' year-over-year as the team continues to press forward with its foray into artificial reality and intelligence.

The impact of this expenditure can be seen in the above graphic. Funds going toward Reality Labs would be expensed under research and development — the largest expense for Meta Platforms during the quarter.

Based on the current Meta stock price, the advertising giant holds a market capitalisation of US$818 billion.