The Nvidia Corporation (NASDAQ: NVDA) share price is stunning markets on Thursday following the release of its first-quarter results for FY2024.

Delivering its latest figures shortly after the closing bell, the US-listed graphics card designer dunked on revenue and adjusted earnings per share (EPS) estimates. In addition, US futures are trading 0.44% higher after the sparkingly result.

The shockingly strong results have sent Nvidia shares into the clouds in after-hours trading. At the time of writing, shares are up 24.7% to US$380.70. Astonishingly, this takes the AI beneficiary to a 160% return for 2023.

AI mania is in full swing

Knowing the reaction, you might be surprised that Nvidia's Q1FY24 revenue actually fell 13% year-on-year to US$7.192 billion. However, analysts were forecasting it to be a far bloodier scene, expecting US$6.5 billion.

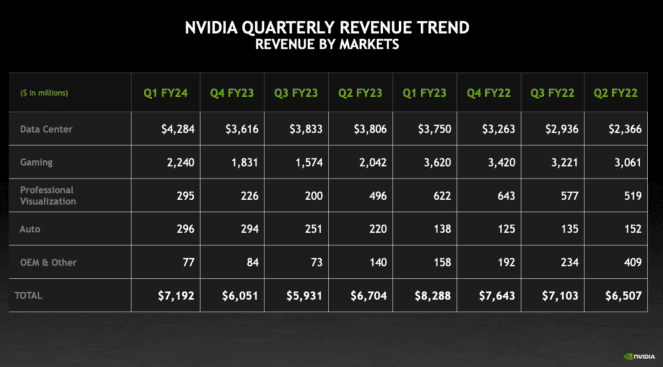

The economic pressures did take a toll on the company's gaming, professional visualisation, and OEM [original equipment manufacturing] segments, with revenues declining compared to the prior corresponding year. These weaker segments were partially offset by record data centre revenue, as shown below.

Buoyed by an insatiable appetite to keep up in the AI arms race, data centre revenues reached US$4.284 billion — increasing 14% on the prior corresponding period. It seems the Nvidia share price has the burgeoning popularity of ChatGPT-like tools to thank for its recent resurgence.

Nvidia CEO and founder Jensen Huang identified an enormous transition in the sector as a major demand driver, stating:

The computer industry is going through two simultaneous transitions — accelerated computing and generative AI.

A trillion dollars of installed global data center infrastructure will transition from general purpose to accelerated computing as companies race to apply generative AI into every product, service and business process.

Despite reduced revenues year-on-year, Nvidia dished out a 26% increase in net income. A 30% reduction in operating expenses allowed it to generate US$2.043 billion on the bottom line.

Jumbo guidance juices up Nvidia share price

The cherry on top for Nvidia shareholders was no doubt the huge forward guidance for second-quarter revenue. Analysts had anticipated US$7.2 billion, but the company blew this out of the water with US$11 billion.

If the chip designer is able to achieve its Q2 forecast, it would represent a 53% quarter-on-quarter increase. Similarly, the figure would be 64% above the prior corresponding period.

All in all, it's music to the ears of those holding Nvidia shares. The share price gain, if it all holds through to tonight's trading, will add roughly US$185 billion in market capitalisation to the company.

The only question left is will the company's future growth support its newfound valuation? It's now trading on a price-to-earnings (P/E) ratio of 196 times.