It's shaping up to be an underwhelming day for financial shares on the Australian share market. However, Commonwealth Bank of Australia (ASX: CBA) shares are among the few bucking the sector trend. The Commbank share price is in the green by 0.26%, hitting $98.10 per share in lunchtime trading.

For context, the financials sector is 0.31% worse off than yesterday. The decline is led by falls in the price of Westpac Banking Corp (ASX: WBC) and Block Inc (ASX: SQ2) shares.

Over the past six months, Australia's largest bank has endured a 7.4% erosion of its market capitalisation. So, what could explain the more positive perspective?

More than a one-trick pony

Following mixed results from the other members of the big four, CBA shareholders were anxiously awaiting big yellow's quarterly figures on Tuesday. Unfortunately, the first-quarter numbers for FY23 received a mixed reception.

As we previously covered, CBA's net interest margin (NIM) weakened by 2% during the quarter. Impacted by competitive pressures, the reduced NIM counteracted the bank's gains in volume growth.

It comes as no surprise that the mere mention of 'competition' coincided with a lacklustre performance in the Commbank share price on Tuesday. At the closing bell, shares had inched 0.23% ahead to $97.34.

For comparison, the share price movements of the remaining big four on earnings were as follows:

- ANZ Group Holdings Ltd (ASX: ANZ) up 1.45%

- Westpac up 1.83%; and

- National Australia Bank Ltd (ASX: NAB) down 6.41%

Today, CBA shareholders might be finding solace in the bank's positioning in lending outside of mortgages. According to the company's release, business banking accounts for roughly 40% of group cash net profit after tax (NPAT).

The exposure to other areas of lending may hold greater importance among investors amid painfully high interest rates.

Where to for the Commbank share price?

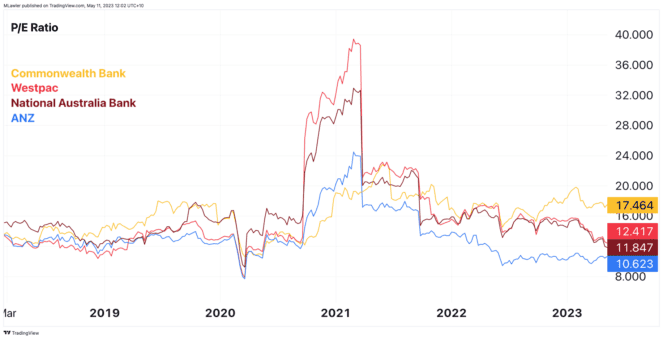

Historically, CBA shares have traded at a premium when compared to its peers. Although, the divergence in premia between the Commbank and the rest has not been this large in the past five years (aside from the anomaly around 2021), as shown in the chart below.

This might suggest investors are anticipating far greater returns from the biggest bank on the ASX. Or, it can turn out to be overvalued. Only the benefit of hindsight can provide the answer.

For now, the team at Citi believes Commonwealth Bank shares could be overvalued, placing a sell rating on the bank and an $80 price target. Meanwhile, UBS is more neutral on the future of the Commbank share price with a $100 price target.