Tapping into the incredible power of compounding can deliver life-changing results to a person's wealth. Yet, some investors tend to only focus on one component of the exponential wealth creation equation when investing in ASX shares, ignoring dividend income.

The growth potential of a company's share price usually attracts most of the limelight in a portfolio, for obvious reasons. However, there is a second compounding machine involving the dividend income that can also be switched on.

Once set up, a shareholder can sit back and watch their dividends go to work for them. So, what is this simple step to amplifying long-term portfolio returns? Follow along to find out and learn how to make use of its power with your own dividend income.

Growing your share of future earnings

In his 2021 annual letter to shareholders, Warren Buffett explained how Berkshire Hathaway investors effortlessly increased their stake in the company, stating:

The action [buyback] increased your ownership in all of Berkshire's businesses by 5.2% without requiring you to so much as touch your wallet.

By using the cash generated by the company's operations, each shareholder was able to hold a larger share of the Berkshire pie, as the number of shares issued was reduced through a buyback program.

In a similar fashion — though not Buffett's preferred option — is for a company to pay a dividend to return a share of the profits to its shareholders. However, this method can be sweetened when an ASX share offers a dividend reinvestment plan (DRP).

Instead of receiving cash, investors can elect to be provided with additional shares to the value of the dividend payment. This effectively increases the investor's holding without needing to contribute additional funds… kind of magical, right?

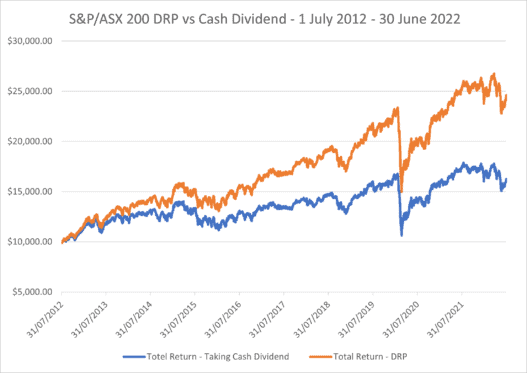

Over time, the impact this simple act can make on total returns is significant. Take the example below, for instance, comparing an investment in the S&P/ASX 200 Index (ASX: XJO) with and without dividends reinvested between July 2012 and June 2022.

In a decade, making use of a DRP would have resulted in a 246% total return. Meanwhile, taking the dividends as cash dragged the total return down to 163%.

An entire 83% additional wealth was generated over 10 years, simply by switching on dividend reinvestments. In my view, that has to be one of the greatest increases in returns for minimal effort that I know of.

How to turn on that extra dividend income

If getting your DRP on sounds like a step you want to take, you're probably wondering how exactly is it done. The procedure for unlocking the great compounding wizardry of dividend reinvestment is as follows:

- Find which share registry your shares use, usually Link Market Services, Computershare, or Boardroom – among others. This can be found in any company correspondence via emails or letters.

- Login to the share registry, navigate to the section usually dubbed 'forms', and select 'Re-investment plans'.

- Follow the prompts to create an instruction to nominate your holdings for full or partial participation in each company's respective plan.

- Sit back and watch your dividends earn dividends…

It's such a quick and painless process that I just switched on reinvestment for two of my own ASX shares just then, in less than a few minutes.

Bonus benefit you may not have known

If DRPs were sweet enough already, this occasional bonus pours even more sugar on top of your dividend income.

In some cases, but not all, ASX-listed companies will offer a discount on the price paid for shares purchased through a DRP. That means getting more shares in your holdings for less than what you could purchase them for on the market.

Examples of ASX shares currently offering a discount on dividend reinvestments include:

- Premier Investments Limited (ASX: PMV): 5% discount

- ARB Corporation Ltd (ASX: ARB): 5% discount

- Jumbo Interactive Ltd (ASX: JIN): 10% discount

It may not seem like a lot right now. However, as the years tick by, the power of compounding can make these attractive reinvestments turn into a monstrous dividend income when you finally elect to receive it as cash.