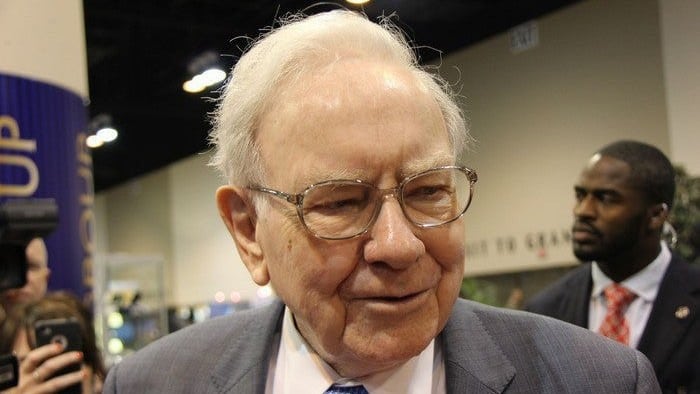

When it comes to investing in ASX shares, you could do a lot worse than listen to the advice of the Oracle of Omaha, Warren Buffett.

Over almost six decades now, the legendary investor's Berkshire Hathaway (NYSE: BRK.B) business has smashed the market with some mind-boggling returns.

In fact, Buffett's most recent letter to shareholders reveals that the conglomerate's book value per share has grown by an average of double the stock market return since 1965.

And that's not because the stock market has delivered pitiful returns. Far from it! The S&P 500 index has generated an average return of 9.9% per annum since 1965. It's just that Buffett has found a way to achieve a return of 19.8% per annum over the same period.

So, what's the secret to Buffett's success? Well, the good news is that there isn't a secret and anyone can follow his investment style.

Investing like Buffett with ASX shares

While Buffett is well-known for loving a bargain, his focus is more on quality than how cheap something looks. He once explained:

It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.

But what makes a company wonderful and how can we find ASX shares with these qualities?

Buffett believes sustainable competitive advantages, or moats, are of the utmost importance when investing. In his 2007 letter to shareholders, he explained:

A truly great business must have an enduring 'moat' that protects excellent returns on invested capital. The dynamics of capitalism guarantee that competitors will repeatedly assault any business 'castle' that is earning high returns.

Therefore a formidable barrier such as a company's being the low-cost producer (GEICO, Costco) or possessing a powerful world-wide brand (Coca-Cola, Gillette, American Express) is essential for sustained success. Business history is filled with 'roman candles', companies whose moats proved illusory and were soon crossed.

Where to find moats on the ASX?

There are a number of ASX shares that have moats. These include toll road operator Transurban Group (ASX: TCL), realestate.com.au owner REA Group Limited (ASX: REA), and biotherapeutics giant CSL Limited (ASX: CSL).

There's also the Buffett-inspired VanEck Vectors Morningstar Wide Moat ETF (ASX: MOAT) to consider, which only invests in companies with moats.

And if you need any more proof that following Buffett's advice could be the smart thing to do, you only need to look at this ETF's returns. Over the last decade, the index it tracks has generated an average return of 18.64% per annum.

That would have turned a $10,000 investment into approximately $55,000 over the 10 years.