The BHP Group Ltd (ASX: BHP) share price is up again today after recording its best day in almost four months yesterday.

The BHP share price is currently $48.30, up 0.52% so far today. It closed the session yesterday at $48.05, up 3.58%.

A stronger iron ore price and China's ongoing economic reopening were behind the big gain.

Fellow ASX 200 mining share Rio Tinto Ltd (ASX: RIO) is also benefitting from this news.

The Rio Tinto share price is up 1.64% today to $126.48. Yesterday, it stormed 3.69% higher.

Are BHP shares the better dividend payer?

Janus Henderson Group (ASX: JHG) has just released its latest Global Dividend Index, which analyses the payouts of 1,200 top global stocks.

As we reported yesterday, ASX shares distributed $97.7 billion in dividends in 2022. That's a new record in Australian dollar terms. And the biggest payer of them all? You guessed it, BHP shares.

BHP paid US$3.25 per share in 2022, which was worth approximately US$16.4 billion in total. That was an 8% year-over-year increase, too.

This is the second year in a row that the Big Australian has been the world's biggest dividend payer.

Rio Tinto made the top 10 dividend payers, coming in at No. 7. In 2021, it was No. 3.

If we look at the report since its inception in 2017, BHP shares and Rio Tinto shares have both been among the world's top 20 dividend payers in 2019, 2021, and 2022. In all three years, BHP paid more.

But remember, these rankings are based on the total dollar amount paid.

It's the dividend yield that really counts for investors

Sure, it's impressive that both ASX 200 mining shares are among the world's top dividend payers, but what really matters to the average investor is the dividend yield they're getting from their investment.

The yield you receive from your ASX dividend shares depends on the price you paid for them. This is because the yield is expressed as a percentage of the price paid.

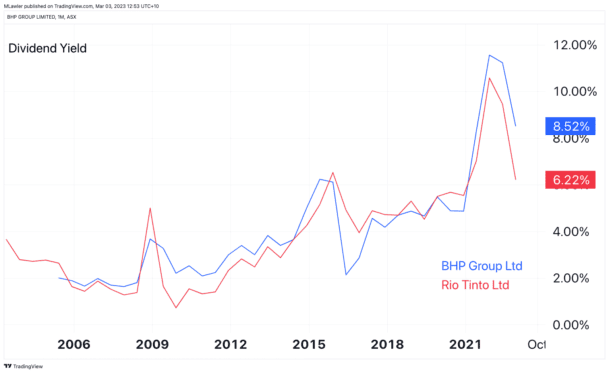

Here is a 20-year chart showing how BHP shares and Rio Tinto shares compare on dividend yields.

This chart goes all the way back to June 2003. The yield is plotted on a 12-month trailing basis with each dividend payment expressed as a percentage of the share price at the time.

Both companies pay semi-annual yields, so about 40 separate 12-month trailing yield points are shown.

As of 31 December 2022, BHP was paying a higher 12-month trailing yield at 8.52% vs. than Rio Tinto at 6.22%.

But there have been times in history when Rio Tinto has paid more than BHP.

If you're interested in dollar amounts per share, let's look back at the past 10 years to get a snapshot.

Between 2013 and 2022 inclusive, BHP shares paid $21 per share in dividends. If we add in franking credits, BHP paid gross dividends of $30 per share. By comparison, Rio shares paid $57.31 per share in dividends (or $81.87 gross).

Last month, BHP released its 1H FY23 results and cut its interim dividend by 40% to 90 US cents per share.

Rio Tinto released its FY22 full-year results and cut its final dividend by 46% to US$2.25 per share