Telstra Corporation Ltd (ASX: TLS) shares have always been famous for the dividend income they pay ASX investors. Since Telstra's privatisation in the 1990s, the telco has doled out dividends to its grateful investors. This reputation has spanned decades now, even as the dividends paid out from the company have fluctuated dramatically.

As it stands today, Telstra offers up a trailing dividend yield of 4.21%, based on the current share price of $3.92 and the trailing annual dividend of 16.5 cents per share. Not too shabby from an objective point of view, one could say. But how does this dividend yield compare to what Telstra has offered up in the past?

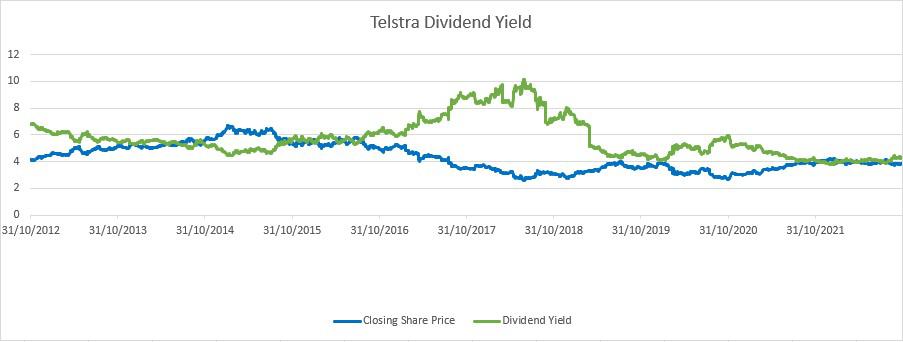

To answer this question, let's analyse Telstra's historical closing share prices against the trailing dividend yield calculated from the dividends the company was paying at the time:

So the first thing to note is that Telstra's dividends have changed quite a lot over the past 10 years. Back in 2012, the company was paying two sets of 14 cents per share dividends every year. Around this time ten years ago, Telstra was going for just over $4 a share. That gave the company a dividend yield of approximately 6.8%.

But this dividend yield spent the next few years on the slide, thanks mostly to the company's rising share price. By late 2014, Telstra shares were trading at around $5.50. Even though Telstra's raw dividends ticked up from an annual 28 cents per share to 28.5 cents by then, the company's yield was down to around 5.1%.

When did the Telstra dividend yield peak?

Telstra's raw dividends peaked at 31 cents per share in early 2016 and stayed at that level until 2018. But when investors got wind that the company was about to dramatically trim its dividends in late 2017 and early 2018, the Telstra share price began falling dramatically. It dropped from around $4 in September 2017 to a low of $2.65 or so by mid-2018.

This saw Telstra's trailing dividend yield soar to almost 10%, but this soon dropped as well when the new Telstra dividends kicked in. It got to around the 4% mark, where it has stayed pretty much ever since. The only notable exception is the COVID market crash of 2020.

Like most ASX shares, Telstra saw its share price crater during this period. It went under $3 in May 2020 and again dipped to around $2.70 in October of that year.

Since Telstra didn't actually cut its dividend at all in 2020, these drops saw the yield spike to around 6% at the time.

But we can conclude that the Telstra dividend yield today is pretty much at the same level investors have been enjoying for years now. However, it is also not even close to the highs that investors enjoyed in years gone by.