This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

The stock market has been on a steady decline since January, and investors are feeling the pinch. The S&P 500, the Nasdaq, and the Dow Jones Industrial Average are all in bear market territory after falling more than 20% from their peaks earlier this year. That can be unnerving for even the most seasoned investors, especially when nobody knows for certain how long this downturn will last.

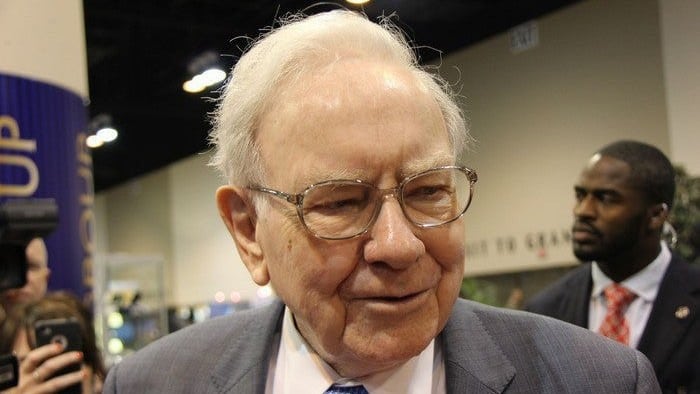

With the right strategy, though, you can give your investments the best chance possible at surviving a bear market. And famed investor Warren Buffett has a few tips that can make these challenging times a little easier.

1. Keep a long-term outlook

It can be tough to stay optimistic right now, as stock prices continue to drop nearly every day. But the market has seen its share of slumps and managed to recover from every one so far.

Back in 2008, Warren Buffett penned an opinion piece for The New York Times, explaining why he was continuing to invest in stocks throughout the Great Recession. In it, the Berkshire Hathaway CEO wrote that:

Fears regarding the long-term prosperity of the nation's many sound companies make no sense. These businesses will indeed suffer earnings hiccups, as they always have. But most major companies will be setting new profit records 5, 10 and 20 years from now.

Nobody -- even Warren Buffett -- can say for certain how the market will perform in the coming weeks or months. But over the long term, it's extremely likely to see positive average returns.

2. Take this opportunity to invest more

When stock prices are falling, throwing more money into the market may be the last thing on many investors' minds. However, continuing to invest during bear markets can be a smart way to build long-term wealth.

During a market slump, high-priced stocks are more affordable. Some companies have seen their stock prices sink by 30%, 40%, 50%, or more so far this year, which gives investors a chance to buy high-quality stocks at a steep discount.

Buffett also encourages investors to take advantage of these buying opportunities. "In short, bad news is an investor's best friend," he writes for The New York Times. "It lets you buy a slice of America's future at a marked-down price."

3. Focus on quality companies

Simply investing during a bear market is only one part of the equation. It's equally important to ensure you're investing in companies that are strong enough to recover from periods of volatility. The best stocks are the ones from healthy companies with solid underlying business fundamentals -- such as a knowledgeable leadership team and strong financials, for example.

Warren Buffett and his business partner Charlie Munger also follow this strategy when choosing investments. "[O]ur goal is to have meaningful investments in businesses with both durable economic advantages and a first-class CEO," Buffett said in a 2021 Berkshire Hathaway shareholders letter. "Charlie and I are not stock-pickers; we are business-pickers."

Investing during a bear market isn't easy, and it's not the right move for everyone. If cash is tight and you can't afford to leave your money in the market for at least a few years, it may be best to avoid investing for now.

But if you can swing it, continuing to invest in solid stocks can be a smart move. Not only can you stock up on strong investments at a discount, but you could also see substantial gains when the market inevitably recovers.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.