This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

With the market in a jittery mood thanks to ongoing inflation, interest rate hike mania, and geopolitical instability, nobody can blame investors who are wringing their hands anxiously in anticipation of a potential market crash. Thankfully, the chances of a crash happening are too difficult to determine with any certainty, so it doesn't make much sense to worry at any particular time.

That probably isn't very reassuring. But what will be reassuring is if you have a plan for what to do and what not to do in the event of a crash. For now, let's work on three things you definitely shouldn't do if there's chaos in the market.

1. Sell your stocks in a panic

The first (and most important) thing you shouldn't do if the stock market crashes is to sell all of your stocks to try to avoid experiencing any further losses. The problem with panic selling is that it feels like the right move. After all, if you can cut your losses fast enough, the market's downward move to the tune of 30% might only lead to losses of 10% for you.

Selling eases the sense of anxiety you have about your lack of control over the situation and your fear of losing money. And if you hear from friends or relatives about how much they got whacked by holding on to their shares, you might even give yourself a pat on the back.

But you'll probably end up missing out on the rebound afterward. And in many cases, that means you'll make less money than if you'd simply stayed the course. Let's examine AbbVie's (NYSE: ABBV) performance during the coronavirus crash in March 2020 as an example.

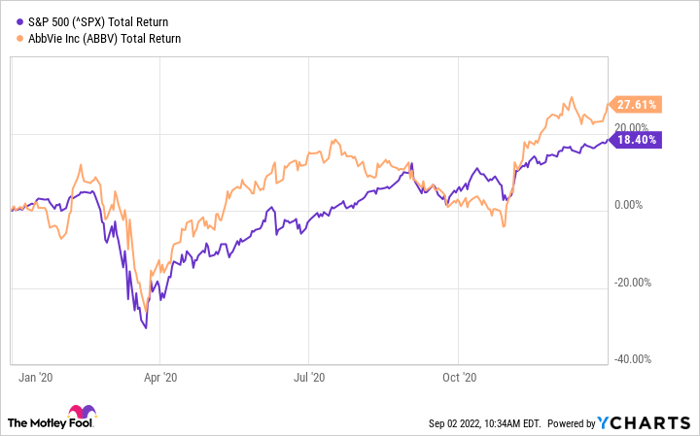

As you can see, AbbVie's shares took a beating during the crash, as did the market. But as the catalyst for the crash, the pandemic, didn't actually do much to affect the company's ability to do its business of developing and commercializing drugs, its stock quickly bounced back.

Within a couple of months, it was outperforming the market, and its earlier damage was entirely reversed. The stock even ended the year significantly above where it started, and you'd have missed out on that gain if you had sold your shares. Even if you tried to restart your position, you'd struggle to time it correctly and you'd almost certainly be missing out on some upside.

There's absolutely no guarantee that every stock will behave the same as AbbVie's did during every market crash, and many will not. In cases where the crash isn't caused by anything that fundamentally impacts a company's ability to make money as efficiently as it currently does, however, selling is likely to be a poor decision.

2. Dramatically change your investing strategy without good reason

In keeping with the above, the second thing that you shouldn't do if the stock market crashes is to switch up your game plan for investing without noodling on it for a good while. It's a fact of life that crashes are often precipitated by economic or global events. Nonetheless, if you have a properly diversified portfolio, it should be unlikely that any specific trend or happening makes all of your stocks genuinely vulnerable to further declines all at once. And that means any changes to your approach should be at the margin, even after a crash.

For example, let's say before the pandemic you held AMC Entertainment (NYSE: AMC) for exposure to the entertainment industry in the same portfolio as your AbbVie shares. The market's collapse in March was caused by fears of the coronavirus, and AMC's share price was hit plenty hard. As an intelligent and far-sighted investor, you held on to your shares at the time. But during your quarterly assessment of your positions, you decide that movie theaters are probably not going to be making a strong comeback for as long as the coronavirus is afoot, and you opt to sell your shares.

So far, so good -- it's important to make adjustments to your strategy when new information makes your original investing thesis incorrect or irrelevant.

Where many investors might go wrong, however, is to then do something like take their proceeds from the sale of AMC and invest them in a way that reduces their portfolio's level of diversification, perhaps by buying more shares of AbbVie. Such an action is a major departure from your prior approach of buying an entertainment industry stock to give yourself exposure to that industry's future growth. And by doing so, you're throwing the baby -- your well-reasoned desire for diversification -- out with the bathwater, which in this case is AMC's poorly performing stock in the wake of the crash.

3. Stay on the sidelines

The final thing investors shouldn't do if the market crashes is to stay on the sidelines and wait for calmer waters. Instead, they should take action to buy while shares are cheaper than normal. And that's especially true if you plan to dollar-cost average to build up your positions. For those who have some capital saved up, sharp and panic-driven downturns are opportunities to shore up your holdings with deeply discounted shares -- once again, assuming that your original investing thesis about why they're worth buying is still valid.

If you do decide to sit on the sidelines during a crash or correction, you won't be actively harming your portfolio's value, but you'll likely be missing out on growth. It's frightening to buy more shares of a stock when it's down and when it seems like the sky is falling, but famous investors like Warren Buffett do it. And for companies that pay a dividend, like AbbVie, buying rather than idling means that you'll be securing shares with higher dividend yields than you could normally get, so you'll get paid for your smart decision to take a hot bargain for years down the line.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.