This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Stock prices have taken a tumble again, ending the bear market rally that investors have seen over the last month. Currently, the S&P 500 is down more than 18% from its peak in early January, and some investors worry the market still has further to fall.

To be clear, nobody -- not even the experts -- knows what exactly to expect over the coming months. The stock market can be unpredictable, so it's tough to say whether stock prices will continue falling or how severe that drop might be if they do.

All that uncertainty can be daunting, and that's normal. But just how worried about the stock market should you be? And should you still invest right now? Here's what you need to know.

What will happen with the stock market?

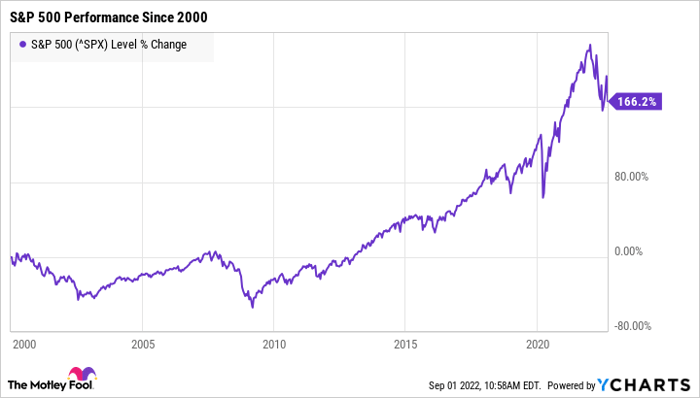

Again, nobody knows for certain how stocks will perform in the near term. However, the market itself has a long history of rebounding from downturns and going on to see positive average returns over time.

In other words, no matter what happens in the coming weeks or months, the market will recover eventually. The best you can do, then, is try to keep a long-term outlook and avoid getting caught up in the market's daily fluctuations.

This doesn't necessarily mean you shouldn't stay informed about market news. But try your best to avoid letting your emotions guide your decisions. Downturns can be nerve-wracking, but the market has experienced dozens of crashes, corrections, recessions, and bear markets over the years. And it's recovered from every single one of them.

Keep in mind, too, that as long as you stay invested, you're unlikely to lose money. If you pull your money out of the market after stock prices have fallen, you'll lock in those losses. But if you simply hold your investments until the market inevitably recovers, you can make it through unscathed.

Is now a good time to buy stocks?

It's often challenging to invest when the stock market is shaky, but it can actually help you make more money over time.

When the market is in a slump, stock prices are lower. While that may not seem like a positive thing, it means you can load up on high-quality stocks for a fraction of the price. Some stocks are down 40%, 50%, 60%, or more from their peaks, making right now a fantastic time to invest at a discount.

Once the market eventually recovers, most stocks should increase in value once again. When that happens, you could potentially see significant gains.

The key is to ensure you're choosing the right investments. Not all stocks can recover from a downturn, but strong companies are the most likely to pull through. By filling your portfolio with healthy companies and holding those stocks for the long term, it's much more likely your investments will survive whatever may happen with the stock market.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.