This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

What happened

After climbing for most of the year, interest rates have fallen sharply over the last month. In the last day, the U.S. 10-year treasury rate is down five basis points to 2.78% while Germany's 10-year is down six basis points to 0.89% and the U.K.'s is down 10 basis points to 1.95%.

Investors were pouring back into high-growth stocks early this week ahead of a very busy few days for earnings. One of the drivers was falling interest rates, but investors also seem to be thinking that the worst of the market's drop is behind us.

Shares of Zoom Video Communications (NASDAQ: ZM) jumped as much as 5.2%, while Asana (NYSE: ASAN) was up 13.5% and fuboTV (NYSE: FUBO) popped 16.4%. Shares of the stocks were up 3.1%, 13.2%, and 13.8% respectively at 11:30 a.m. ET.

So what

Investors often discount expected future cash flows by a discount rate derived from the 10-year rate, so falling rates are often seen as great news for equity values.

Fubo made news last week by saying it was looking for strategic alternatives for its gambling business. The company has been burning through cash, and with its falling stock price it's time to focus the business on becoming more sustainable.

Asana and Zoom both release quarterly results later this month, and that could give more clarity about their growth prospects long-term. For now, the "risk-on" trade is enough to push shares higher.

Now what

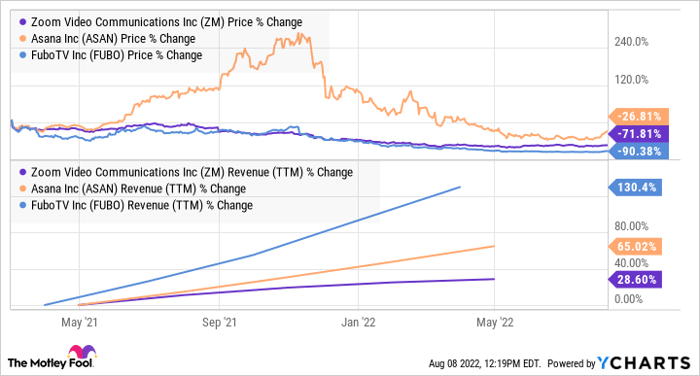

At some point, growth stocks will be undervalued by the market, and we may be seeing that in pockets. You can see in the chart below that all three of these companies have grown at a rapid clip over the past year, but their stocks are down dramatically.

Lower interest rates might help these stocks in the short term, but over the long term they'll need to generate cash flow to survive. Zoom is already generating cash, but Asana and FuboTV may need to both grow the top line and cut expenses to survive.

I think the recovery in growth stocks will continue this year, but it won't be even. Not every company will survive, and we're already seeing some companies be sold for fire sale prices compared to their stock peaks. Asana and FuboTV may be on that list if they aren't able to get operations to a sustainable point.

For now, today's move should be seen as noise in a wild market, but when earnings are released, we'll know more about the future of these companies.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.